Buying a licensed remodeling business can save you time and effort compared to starting from scratch. You gain access to an established customer base, ongoing contracts, skilled staff, and essential equipment. However, there are key challenges to consider:

- Licenses Don't Automatically Transfer: Most contractor licenses are tied to individuals or specific business entities. If the license holder leaves or the business structure changes, you may need to reapply for a new license.

- Due Diligence Is Critical: Verify licenses, financial records, and customer relationships to avoid hidden risks like unpaid fees, expired licenses, or non-assignable contracts.

- Compliance Is Non-Negotiable: Operating without a valid license, even briefly, can lead to severe penalties, including forfeiting all compensation for work done during that time.

To ensure a smooth transition, plan for license transfers, secure financing, and retain key staff. Proper preparation minimizes risks and sets the stage for success.

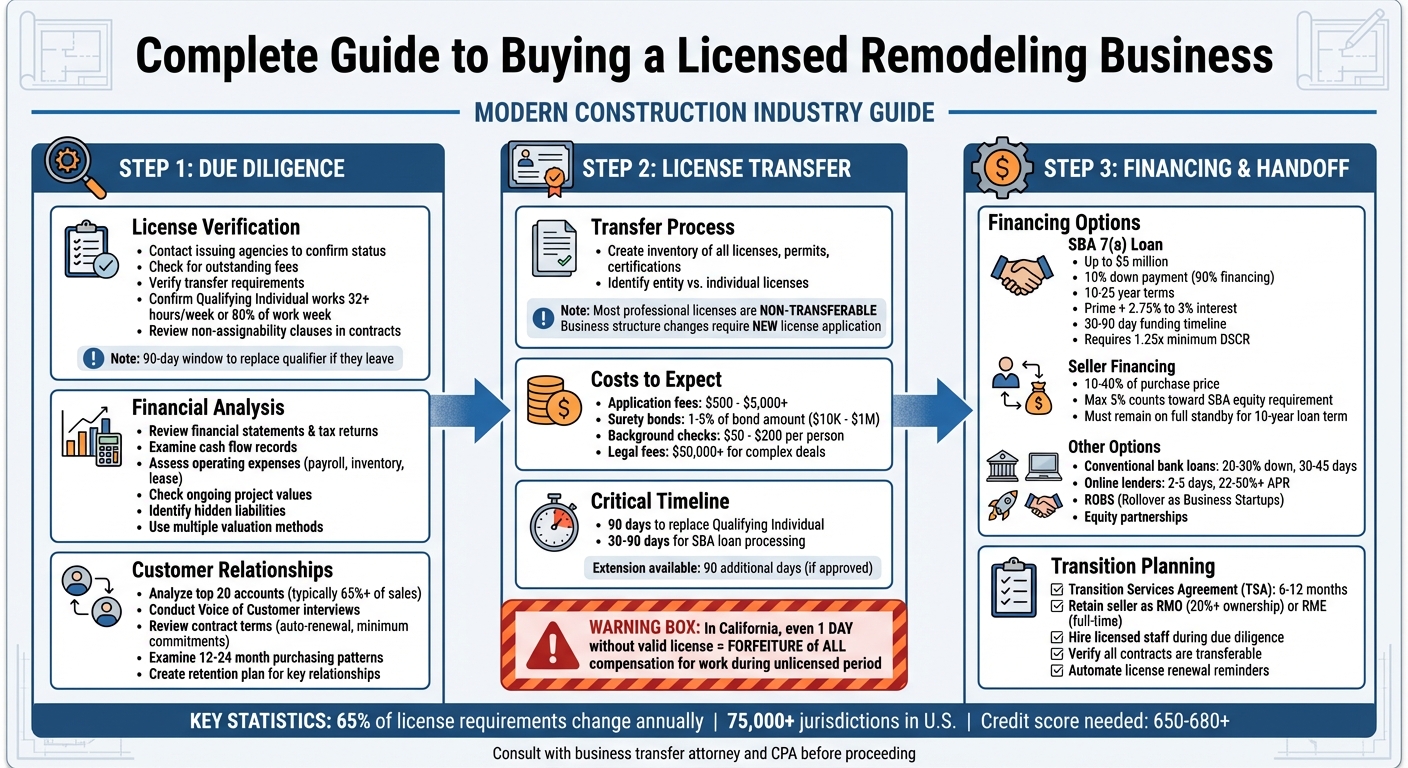

Complete Guide to Buying a Licensed Remodeling Business: Due Diligence Checklist

Can You REALLY Buy a Trades Business Without Holding a License?

sbb-itb-a3ef7c1

Due Diligence: Evaluating the Business Before Purchase

Performing due diligence is like peeling back the layers of a business to reveal any hidden risks that could derail your investment. This process involves verifying licenses, analyzing financial records, and assessing customer relationships. Skipping these steps can lead to unexpected challenges, such as lost revenue or even operational shutdowns.

Given how quickly regulations can change, relying on assumptions is risky. David Brillant of Brillant Law Firm puts it clearly:

"The best time to call a business transfer attorney is before you think you need one. By the time most owners reach out, they're already facing tight deadlines or unexpected complications."

Let’s break down the due diligence process into three main areas: license verification, financial analysis, and customer relationship evaluation.

Verifying Licenses and Permits

Start by gathering all relevant license documents and contacting the issuing agencies to confirm their status, any outstanding fees, and transfer requirements. This step ensures you have a clear picture of all licenses and their expiration dates.

Pay close attention to how licenses are structured. In many states, licenses are tied to a specific corporate registration number. If this number changes during the sale - for example, if the business transitions from a sole proprietorship to an LLC - the license may no longer be valid, requiring a new application. Pam Scholefield of Scholefield, P.C. explains:

"A contractor's license isn't up for sale. It is not like a liquor license that can get sold to the new owners along with the business assets and trade name. This is because of the need for a qualifier."

If the business relies on a Qualifying Individual (often called an RMO or RME), confirm they are actively involved in operations for at least 32 hours or 80% of the work week. If this individual leaves, licensing boards typically require notification within 90 days, leaving a tight window to find a replacement or secure your own credentials.

Additionally, review current construction contracts for any non-assignability clauses. Some agreements require client consent to transfer work to a new entity, which could disrupt revenue if licenses don’t transfer smoothly.

To protect yourself, include representations and warranties in the purchase agreement that confirm all licenses are in good standing. Add indemnity clauses to shield you from potential license issues after closing. If the seller is the sole license holder, consider negotiating a transition services agreement (typically for 6–12 months) to allow time to secure your own credentials.

Once you’ve confirmed license validity, the next step is a deep dive into the business’s financial health.

Analyzing Financial Records and Profitability

Reviewing financial records is essential to understanding the true profitability of the business and uncovering any hidden liabilities. Start by examining financial statements, tax returns, and cash flow records. Pay special attention to operating expenses like payroll, inventory costs, and lease obligations to get a clear picture of monthly costs.

Look at ongoing project values and upcoming contracts to ensure the business will have cash flow immediately after acquisition. Be cautious of hidden liabilities, such as unpaid licensing fees or unresolved violations, which could result in future penalties.

In the remodeling industry, even a brief lapse in licensing can lead to forfeited compensation for all work performed during the unlicensed period. Past cases have shown that temporary licensing gaps can result in substantial losses. Verifying licenses is critical to avoiding such revenue risks.

To ensure accuracy, work with an accountant to assess the full costs of purchasing and operating the business, as well as to estimate potential profits. Use multiple valuation methods - such as the capitalized earning approach, the excess earning method, or the cash flow method - to get a well-rounded view of the business’s worth.

Reviewing Customer Relationships and Reputation

Customer relationships are often the backbone of a remodeling business. In many cases, clients are loyal to specific individuals, like the current owner or a lead project manager, rather than the business itself. If these key people leave, revenue could take a hit.

Start by analyzing the top 20 accounts or clients, which typically represent at least 65% of total sales. Nicole Gralapp, CPA at SVA Certified Public Accountants, highlights their importance:

"Customer relationships are central to most business transactions and the ability to maintain, or even enhance, those relationships post-transaction can unlock significant value embedded in the deal."

Consider hiring a third party to conduct confidential "Voice of Customer" interviews or satisfaction surveys. This approach allows you to gather honest feedback on quality, delivery, and pricing without breaching confidentiality. Also, investigate why past top customers left - whether due to pricing, quality issues, or competition - to identify potential risks.

Review customer contracts for automatic renewal clauses, minimum purchase commitments, and consistent pricing terms. Examine purchasing patterns over the past 12 to 24 months to determine whether revenue comes from one-time projects or sustainable, recurring work. This will help you spot customer concentration risks.

Finally, create a plan to retain key relationships. Identify which customers are loyal to the current owner and develop strategies to maintain those accounts. Encourage key employees to stay on post-acquisition, as their relationships can be vital to retaining clients. By thoroughly assessing customer relationships, along with verifying licenses and analyzing finances, you can reduce risks and set the stage for long-term success.

How to Transfer Licenses and Maintain Compliance

Once you've done your due diligence, the next step is transferring licenses without any operational hiccups. Contractor licenses are typically tied to specific individuals or business structures, and the rules for transferring them can vary widely depending on the state. Getting this process right is crucial to ensuring your operations continue smoothly. Let’s dive into the details of how to handle license transfers and stay compliant with regulations.

License Transfer Process

Start by creating a comprehensive inventory of all the business licenses, permits, and certifications involved. Identify which licenses are tied to the business entity and which belong to individuals, such as a seller's personal contractor license. Keep in mind that in most states, professional licenses are non-transferable. This means that buying a business doesn’t automatically transfer the seller’s credentials to you.

In states like California, Nevada, and Arizona, contracting businesses are required to have a Qualifying Individual - someone like a Responsible Managing Officer (RMO) or Responsible Managing Employee (RME) - who meets specific experience and testing requirements. If this person leaves, the business typically has 90 days to replace them, or the license may be suspended.

To avoid disruptions, consider one of these approaches:

- Hire licensed staff during due diligence, with their employment contingent on the deal closing, so they’re ready to step in immediately.

- Work with retired professionals who hold the required certifications and pay them a fee to serve as the qualifier temporarily.

- Retain the seller on a short-term basis post-acquisition to maintain compliance while you secure your own credentials.

If the business structure changes, you’ll likely need to apply for a new license rather than transferring the existing one. Licenses are tied to specific registration numbers issued by the Secretary of State, and any change to that number can invalidate the license.

Be prepared for costs. Application fees can range from $500 to over $5,000, and additional expenses might include surety bonds (1% to 5% of the bond amount, which can range from $10,000 to $1 million), background checks ($50 to $200 per person), and legal fees (which could exceed $50,000 for complex acquisitions).

Once you’ve outlined the general process, it’s time to dig into state-specific rules.

State-Specific Licensing Rules

Each state has its own licensing requirements, and misunderstanding them can lead to costly mistakes. For example, California has strict rules: even a one-day lapse in licensing can result in losing all compensation for work done during that unlicensed period. Marion Hack, a Partner at Troutman Pepper, highlights the risks:

In California, even a lapse of a license for one day has dire consequences. Indeed, a contractor forfeits compensation for all work performed under a contract when the contractor is unlicensed for any period during that contract.

A real-world example of this is the 2015 case of Judicial Council of California v. Jacobs Facilities Inc.. Here, Jacobs Facilities reorganized its business and transferred employees to a subsidiary. Although the subsidiary obtained a license, Jacobs let its own license expire before officially assigning the contract. As a result, the California Court of Appeal ruled that Jacobs forfeited all compensation for work done during the unlicensed period, even though the work was completed and the client had been informed of the reorganization.

To avoid pitfalls like this, contact your state licensing board - such as the CSLB in California - well before closing to understand the exact transfer procedures and processing times. With about 65% of license registration requirements changing annually across more than 75,000 jurisdictions in the U.S., staying informed is essential. If you can’t replace a qualifying individual within the usual timeframe, apply for a 90-day extension from the licensing board.

Set up automated reminders for license renewal dates and submission deadlines to ensure you don’t miss any filings that could lead to stop-work orders. Additionally, verify that all existing construction contracts can legally be assigned to the new business entity only after you’ve secured a valid license in your name. By staying on top of state-specific rules and planning ahead, you can keep your operations compliant and avoid costly gaps in licensure.

Financing Options and Transition Planning

After navigating the licensing process, the next steps involve securing funding to close the deal and ensuring a smooth operational handoff. Acquiring a remodeling business requires understanding financing options - each with its own conditions and timelines - and crafting a transition plan to maintain seamless operations.

How to Finance a Remodeling Business Acquisition

One popular option is the SBA 7(a) loan, which can finance up to $5 million. These loans typically cover up to 90% of the purchase price, requiring a down payment as low as 10%. Repayment terms range from 10 to 25 years, with interest rates usually falling between Prime + 2.75% and Prime + 3%. However, the funding process can take 30 to 90 days, and lenders often require a minimum DSCR (Debt Service Coverage Ratio) of 1.25x.

Another common approach is seller financing, where the seller finances 10% to 40% of the purchase price. This method bridges the gap between your down payment and other financing sources. As Robert Duffy, Senior Vice President at BDC, puts it:

"If the vendor is owed $3 million after closing, they are going to be motivated to make sure the business survives the transition and continues to thrive."

For SBA loans, seller financing must not exceed 5% of the purchase price to count toward the 10% equity requirement. Additionally, these seller notes must remain on full standby (no payments) for the loan's 10-year term.

Other financing options include conventional bank loans, which close in 30–45 days but require 20–30% down payments and stricter credit standards. Online lenders offer faster funding (2–5 days) but come with higher APRs, often ranging from 22% to over 50%. Creative alternatives include using retirement funds through a ROBS (Rollover as Business Startups) structure, forming equity partnerships, or seeking mezzanine financing.

Before reaching out to lenders, you'll need to prepare thoroughly. Start by drafting a signed Letter of Intent (LOI) that outlines the deal structure and purchase price. Obtain a professional third-party valuation of the business and ensure your personal credit score is in the 650–680 range. Platforms like Clearly Acquired can help match buyers with lenders using real underwriting criteria, making it easier to build the right capital stack.

With financing secured, the next step is planning a seamless business transition.

Planning for Business and Staff Transition

Once funding is in place, focus on ensuring an effective operational handoff. Retaining licensed staff and maintaining strong client relationships are critical to avoiding disruptions. A Transition Services Agreement (TSA) can be a valuable tool, allowing the seller to stay involved for 6–12 months post-acquisition. This arrangement helps bridge operational gaps and provides training while new credentials are finalized.

Make sure all client contracts are legally transferable to the new, properly licensed entity to avoid legal complications. If the seller is the sole license holder, consider keeping them on temporarily as a Responsible Managing Officer (RMO) with at least 20% ownership or as a Responsible Managing Employee (RME) in a full-time capacity. Alternatively, hiring licensed individuals during due diligence ensures qualified staff are ready to step in on day one.

To streamline operations, automate license renewal reminders and keep all documentation centralized and organized. With proper planning and attention to detail, you can ensure a smooth transition and minimize costly disruptions.

Conclusion

As we've discussed, due diligence and regulatory compliance are absolutely critical when acquiring a licensed remodeling business. Licenses are not automatically transferable - they're tied to the business structure and the qualifying individual. If the seller is the sole qualifier and leaves without a proper transition plan, you’ll have just 90 days to replace them before the license is suspended.

The financial risks are no joke. In states like California, even a single day without a valid license can result in disgorgement. This means you could be forced to return all payments received for any work completed while unlicensed. A seemingly small oversight could jeopardize your entire business, making thorough due diligence a non-negotiable step.

What Buyers Should Remember

To ensure a smooth and successful acquisition, keep these key points in mind:

- Verify the status of the qualifier and consider securing a 6–12 month Transition Services Agreement (TSA). This will give you time to either obtain your own credentials or hire a licensed Responsible Managing Employee (RME).

- Double-check that the corporate registration number aligns with license records in every state where the business operates. Also, confirm that all active contracts are legally transferable to your new entity.

-

Engage qualified consultation services early in the process. As David Brillant from Brillant Law Firm wisely advises:

The best time to call a business transfer attorney is before you think you need one. By the time most owners reach out, they're already facing tight deadlines or unexpected complications.

Additionally, include protective clauses like representations, warranties, and indemnities in your acquisition agreements to address any licensing issues that may arise post-closing.

With around 65% of license requirements changing every year, staying proactive about compliance is essential. A carefully planned acquisition not only safeguards your investment but also ensures that your operations remain uninterrupted. This preparation is key to helping you succeed as an entrepreneur in the remodeling industry.

FAQs

Can I keep operating while the contractor license is being reissued?

Yes, your business can keep operating during the reissuance process, as long as a Qualifying Individual continues to be employed. Their role is crucial for maintaining the license's validity until the reissuance is finalized.

What deal terms protect me if the license or qualifier falls through after closing?

When a deal closes, licenses or qualifications can sometimes pose challenges. To address this, agreements often include terms requiring the seller to help with transferring licenses or reapplying for them. Since many licenses are non-transferable and linked to specific individuals or entities, buyers may also negotiate clauses to ensure they can obtain a new license if necessary.

How can I ensure customer contracts and permits transfer to my new entity?

To make sure customer contracts and permits move seamlessly to your new entity, start by checking local regulations to determine which licenses and permits can be transferred. During due diligence, confirm their current status to avoid surprises. Reach out to licensing authorities to handle the transfer process or reapply if necessary. Taking these steps ahead of time helps ensure compliance and a smooth transition.

%20%20Process%2C%20Valuation%20%26%20Legal%20Checklist.png)

%20in%20a%20%2420M%20Sale..png)

%20vs.%20Conventional%20Loans%20for%20business%20acquisition.png)

.png)

.png)

.png)

.png)