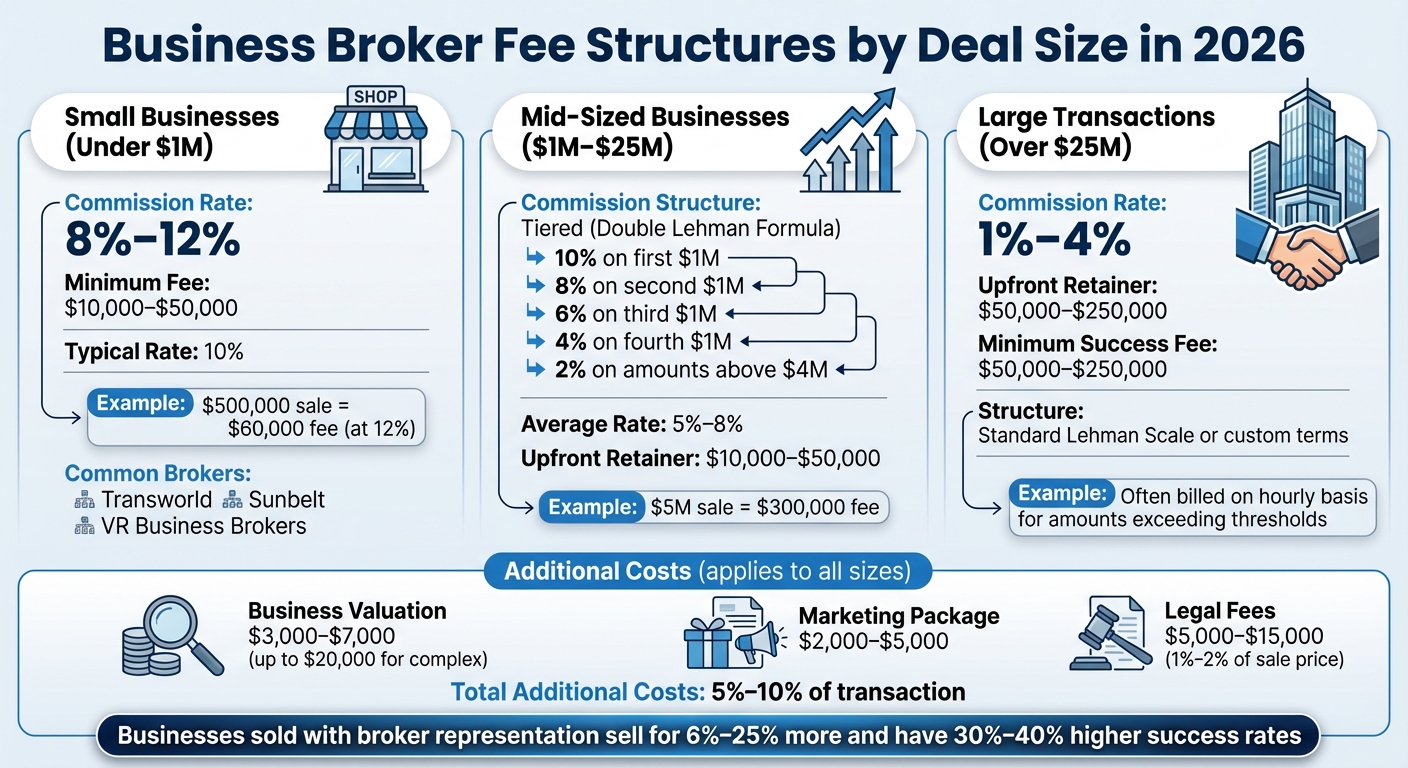

If you're selling a business in 2026, expect broker fees to vary based on the size and complexity of the deal. Here's a quick breakdown:

- Small businesses (under $1M): Brokers typically charge 8%–12% of the sale price, with minimum fees ranging from $10,000 to $50,000.

- Mid-sized businesses ($1M–$25M): Fees often follow tiered structures, like the Double Lehman formula. Rates may start at 10% for the first $1M and decrease for higher amounts, averaging 5%–8% overall.

- Large transactions (over $25M): Fees are lower, often 1%–4%, with upfront retainers ranging from $50,000 to $250,000.

Additional costs include marketing, legal, and valuation fees, which can add another 5%–10% to the total.

To get the best deal:

- Compare quotes from multiple brokers.

- Negotiate tiered fee structures or discounts for exclusive agreements.

- Review all terms in writing, including minimum fees and tail clauses.

Choosing to sell your business to qualified buyers through a broker can increase your chances of a successful sale and often results in higher sale prices, but understanding their fee structure is key to protecting your earnings.

Business Broker Fee Structures by Deal Size in 2026

Business Broker Fee Structures in 2026

Commission-Based Fees

In a commission-based model, brokers earn their fees only when a sale is successfully completed. For smaller businesses valued under $1 million, commission rates typically fall between 8% and 12%, while mid-sized businesses (valued between $1 million and $10 million) often see blended rates averaging 5% to 8%.

Many brokers use a tiered commission scale, such as the Double Lehman formula, which is common for smaller mergers and acquisitions (M&A). Under this structure, the commission decreases as the sale price increases: 10% on the first $1 million, 8% on the second, 6% on the third, 4% on the fourth, and 2% for amounts beyond that.

"The most common business broker commission range is ten percent to fifteen percent for businesses sold between $100,000 to $1,000,000."

– Gil Sanchez, Esq., Founder & CEO, Tempus Business Strategists, LLC

Most brokers also set minimum commissions, which usually range from $10,000 to $50,000. For businesses valued under $100,000, brokers may charge a flat fee, often between $10,000 and $15,000. Exclusive listing agreements, where the broker is guaranteed the sale, generally come with lower commission rates (6%–10%) compared to open listings, which range from 10% to 12%. This structure reflects the broker's commitment to marketing and selling the business.

While commission-only models are still widely used, many brokers now incorporate upfront fee structures into their pricing.

Flat-Fee and Retainer Pricing

Upfront retainers are increasingly common, especially in lower-middle-market transactions. For smaller businesses (often referred to as Main Street businesses), retainers typically range from $10,000 to $25,000, while more complex M&A deals may require retainers exceeding $50,000. In most cases, these upfront fees are credited toward the closing fee.

"The more experienced the broker, the higher the likelihood they will charge up-front fees, especially if they invest a significant amount of time preparing and packaging a business for sale."

– Jacob Orosz, President, Morgan & Westfield

For larger transactions exceeding $25 million, retainers can range from $50,000 to $250,000, often billed on a monthly basis. Additionally, some brokers offer standalone services, such as business valuations or consulting, which are billed hourly at rates between $50 and $300.

Additional Fees and Charges

Beyond the primary fees, business owners should be aware of additional costs that can significantly impact the total expense. For instance, business valuations typically cost between $3,000 and $7,000, though more complex evaluations for larger companies may reach up to $20,000. Marketing packages - which might include professional photography, video tours, and targeted advertising - generally cost between $2,000 and $5,000.

Legal fees, which are not included in broker commissions, often range from $5,000 to $15,000 (about 1% to 2% of the sale price). For larger businesses requiring financial audits, these fees can exceed $10,000. Additional administrative charges for services like document review, data room setup, and buyer verification may also apply. Altogether, these extra costs can add 5% to 10% to the overall transaction expenses.

sbb-itb-a3ef7c1

What Affects Business Broker Fees

Deal Size and Transaction Complexity

The size of the deal has a direct impact on broker fees. Generally, as the sale price of a business increases, the commission percentage tends to decrease. For instance, selling a business for $500,000 might come with a 10% commission, translating to $50,000. However, for a $5 million transaction, the rate could drop to somewhere between 5% and 8%, equating to fees of $250,000 to $400,000.

The complexity of the transaction also plays a role in determining fees. Deals involving multi-location businesses, distressed assets, or industries with heavy regulatory requirements - such as healthcare or logistics - demand more effort and expertise from brokers. This additional workload often results in higher fees.

For smaller transactions, many brokers implement minimum commission thresholds, typically ranging from $10,000 to $50,000. For example, if you sell a business for $75,000, you might still be required to pay a flat fee of $10,000. These factors, combined with deal size, naturally lead into how industry specifics further shape broker fees.

Industry Type and Location

The type of industry a business operates in significantly influences broker fees. Industries with strict regulations - like healthcare, pharmaceuticals, or technology - often require brokers with specialized knowledge. This expertise ensures accurate valuations and smooth navigation of compliance issues, which can result in higher fees.

"Some sectors, like technology or healthcare, often see higher broker fees due to the specialized knowledge required and the higher average sale price of businesses in these fields."

– Michael Steinberg, CEO and Founder, HedgeStone Business Advisors

Location is another major factor. Brokers in rural areas may face higher marketing expenses since they need to broaden their search for qualified buyers. In contrast, urban markets typically have larger pools of local buyers, which can streamline the sales process and, in some cases, reduce fees. Regional practices also influence pricing. For example, the approach to brokering deals in New York City can differ greatly from that in more remote areas like Montana.

Broker Experience and Track Record

A broker’s experience and performance history often justify higher fees. Seasoned brokers bring extensive buyer networks and a proven ability to close deals, which not only supports their higher rates but can also lead to quicker transactions and better valuations for the seller.

Brokers who work solely on commission often charge higher rates to account for the fact that they close only about 40% of the deals they manage. The fees from successful transactions help offset the time and effort spent on deals that don’t go through.

Business Broker Fee Examples by Deal Size

Main Street Deals (Under $1 Million)

Smaller businesses tend to face higher percentage fees, often paired with minimum fee thresholds. For businesses selling under $1 million, brokers generally charge between 8% and 12% of the final sale price, with 10% being a common figure. However, minimum fees - ranging from $10,000 to $50,000 - can apply, even if the percentage calculation results in a lower amount.

For example, if a business sells for $500,000 at a 12% rate, the broker's fee would be $60,000. On the other hand, a $250,000 sale might trigger a minimum fee of $30,000 if the percentage-based fee falls short.

"Most business brokers charge a minimum fee between $10,000 and $25,000."

– Jacob Orosz, President, Morgan & Westfield

Some brokers also use tiered fee structures for deals nearing the $1 million mark. For instance, they might charge 15% on the first $500,000 of the sale and 10% on the remainder. For very small businesses, often valued under $100,000, brokers may opt for a flat fee to ensure the transaction remains worthwhile. Large franchise firms like Transworld Business Advisors, Sunbelt Business Brokers, and VR Business Brokers typically set their minimum fees at $50,000 or higher.

As deal sizes grow, fee structures shift to reflect the complexity and scale of the transaction.

Lower-Middle-Market Deals ($1M–$25M)

For businesses selling in the $1 million to $25 million range, brokers often adopt tiered fee structures, such as the Double Lehman Scale. For instance, in a $5 million transaction, the Double Lehman Scale might apply as follows: 10% on the first $1 million, 8% on the second, 6% on the third, 4% on the fourth, and 2% on the fifth. This would result in a total fee of approximately $300,000. Similarly, in a $9 million deal, the fee might total around $380,000, with 2% applied to amounts exceeding the structured tiers.

In addition to these percentage-based fees, brokers often require upfront retainers ranging from $10,000 to $50,000 and minimum success fees between $50,000 and $250,000.

For larger transactions within this range, fee models continue to evolve to account for the broader services required.

Large Transactions (Over $25 Million)

For deals exceeding $25 million, brokers and M&A advisors typically use the Standard Lehman Scale or a Modified Lehman Scale, which feature lower percentage rates. Under the Standard Lehman formula, fees are calculated as 5% on the first $1 million, 4% on the second, 3% on the third, 2% on the fourth, and 1% on amounts beyond $4 million. Some firms may negotiate custom terms, such as 2% on the first $10 million, with reduced rates for amounts above that threshold.

These larger transactions almost always involve upfront retainers - ranging from $5,000 to $50,000 or more - and minimum success fees between $50,000 and $250,000. Consequently, the overall blended commission rate for transactions exceeding $10 million typically falls between 1% and 4%.

"As you go higher (in price), the fees may be less based on a (percentage) and more on billable hours."

– Colin Ma, Co-founder, Niche Pursuits Community

The complexity of these transactions - such as targeting strategic buyers, handling recapitalizations, or managing buyouts - justifies the fee structure, as it reflects the extensive services required for such high-value deals.

How to Evaluate and Negotiate Broker Fees

Evaluating Broker Services

When deciding if a broker's fees are worth it, take a close look at the services they provide. Start by examining their marketing reach and access to potential buyers. Experienced brokers often use specialized databases like BizBuySell and have a track record of pre-qualifying buyers effectively. Ask for concrete metrics, such as how many deals they’ve closed in your industry and the average time it takes them to finalize a sale. These numbers can give you a clearer picture of their expertise.

Pay attention to how their incentives are structured. Brokers who work entirely on commission might prioritize quick deals over quality outcomes. On the other hand, those who charge upfront retainers may focus more on maximizing the value of your business. As Jacob Orosz, President of Morgan & Westfield, points out, "A straight commission model incentivizes the broker to sell your business as fast as possible with minimal effort." Additionally, find out if the broker works with a team that handles financial analysis, valuations, and buyer screening, or if they operate solo. A team-based approach often brings more resources to the table.

Industry-specific experience is another crucial factor. This is especially important in fields like healthcare or technology, where regulations, licensing, and complex transitions require specialized knowledge. Also, inquire about the broker’s stance on co-brokering, as this can expand the pool of potential buyers. Once you’ve assessed their services, you’ll be in a better position to negotiate terms that safeguard your earnings.

Fee Negotiation Tactics

To ensure you’re getting a fair deal, gather quotes from at least three brokers to compare pricing. While cost matters, don’t let it overshadow the importance of quality service. As Andrew Cagnetta, CEO of Transworld Business Advisors, emphasizes, "You get what you pay for. Quality service justifies the cost."

Consider negotiating a tiered success fee structure. For instance, you could propose a model where the broker earns 10% on the first $1 million of the sale and 8% on the next portion. This structure helps protect your earnings on higher-value deals. You might also negotiate an exclusive listing agreement in exchange for a small discount, such as a 1% to 3% reduction in the commission rate. If a retainer fee is required, try to cap it and ensure it’s credited toward the final commission.

Another way to save is by bringing your own buyer to the table. In such cases, you could negotiate a lower commission or even a flat fee to cover the broker’s role in finalizing the deal. Always confirm minimum commission requirements upfront to avoid surprises if the final sale price is lower than expected. Once an agreement is reached, make sure all terms are documented in writing.

Documenting Fee Agreements

Before the broker starts marketing your business, formalize all fee arrangements in a written listing agreement. This document should clearly state the commission percentage, any upfront retainer fees (including whether they’re refundable or credited toward the final fee), and any other costs.

Pay close attention to the "tail clause." This clause outlines the period after the agreement ends during which the broker is still entitled to a fee if a buyer they introduced closes the deal. Aim to negotiate a shorter tail clause - ideally less than six months - to maintain flexibility for future transactions.

Lastly, request a detailed breakdown of any marketing or administrative expenses. Determine whether these costs are included in the commission or billed separately. To protect your interests, have an attorney review the agreement to ensure it aligns with your goals and any escrow arrangements. Proper documentation is key to avoiding disputes and ensuring a smooth transaction.

Business Broker M&A Fees - Cost To Sell Your Business?

Conclusion

Knowing how business broker fees work is essential for both buyers and sellers in 2026. For small businesses valued under $1 million, fees generally range from 8% to 12%, while mid-sized deals between $1 million and $25 million typically fall between 4% and 8%. When you factor in additional costs like marketing, legal support, and due diligence, total expenses can reach up to 15% of the sale price. These costs highlight the value of hiring experienced professionals to guide the process.

Broker fees aren't just an expense - they're an investment in expertise that can significantly impact your bottom line. Businesses sold with professional representation often fetch 6% to 25% more than those sold by owners alone. Plus, sellers who go it alone face a 60% to 70% lower chance of closing a deal successfully. A skilled broker brings industry insights, access to a network of buyers, and sharp negotiation skills, often making their commission well worth it.

Before choosing a broker, compare at least three options and evaluate their experience in your industry. Pay close attention to their fee structures - whether they follow commission-based models like the Lehman Formula, require upfront retainers, or add marketing fees. Understanding these terms in advance helps you avoid surprises later. Many sellers can negotiate 1% to 3% lower commission rates by offering exclusivity or suggesting tiered fee arrangements. The focus shouldn’t just be on finding the cheapest option but on selecting a broker whose services align with your goals and justify their cost.

Since broker fees represent one of the largest expenses in selling a business, being well-informed gives you the upper hand. By understanding the typical rates, fee structures, and negotiation strategies, you can make smart, confident decisions that protect your financial interests and set the stage for a successful sale.

FAQs

How can I negotiate lower fees with a business broker?

Negotiating lower fees with a business broker starts with knowing how their pricing typically works. Most brokers charge a commission between 8% and 12% of the final sale price, but this can vary depending on factors like your business's size or the deal's complexity. Sellers might lower these costs by emphasizing the value of their business, taking on some of the sale-related tasks themselves, or showing that there’s strong interest from buyers.

To improve your negotiating position, dig into industry standards and fee structures. Look into whether the broker uses a success-based commission, upfront retainers, or tiered fees. If your transaction is large or especially competitive, brokers may be willing to shave off 1-3% from their rates. You might also consider flat-fee arrangements or ask for reduced commissions in exchange for fewer services, such as scaling back on marketing efforts. The key is to come prepared, understand your goals, and have a clear plan to align the broker’s fees with your needs.

What affects the commission rate charged by a business broker?

Several elements come into play when determining the commission rate a business broker charges. One of the biggest factors is business size. Smaller businesses typically face higher percentage commissions, usually ranging from 8% to 12%. On the other hand, larger or mid-sized businesses often see lower rates, around 4% to 8%.

Other considerations include industry type and location. Certain sectors or markets might involve more intricate transactions, which can influence the rates brokers charge. The type of listing also matters - exclusive listings often lead to more favorable terms compared to open listings.

In addition, brokers may charge success fees upon closing a deal or request upfront retainers to cover costs like marketing and valuation. Factors like negotiation, current market conditions, and the complexity of the transaction also play a role. Sellers with simpler deals or strong negotiating leverage might secure lower fees.

Do upfront retainers count toward the final commission?

Not necessarily. Whether an upfront retainer counts toward the final commission depends entirely on the agreement you have with your broker. Some brokers may apply the retainer to the overall commission, while others might consider it a separate, non-refundable fee meant to cover initial services or expenses.

To steer clear of any misunderstandings, it's crucial to discuss this detail with your broker before signing a contract. Ensure you're clear on how the fees are structured and how they fit with your goals for the transaction.

%20%20Process%2C%20Valuation%20%26%20Legal%20Checklist.png)

%20in%20a%20%2420M%20Sale..png)

%20vs.%20Conventional%20Loans%20for%20business%20acquisition.png)

.png)

.png)

.png)