When buying a business, you’ll need to choose between two main deal structures: asset purchases or stock purchases. This decision affects taxes, liabilities, and how contracts transfer. Here’s the key difference:

- Asset Purchase: The buyer picks specific assets (like equipment, inventory, or goodwill) and avoids taking on the seller’s legal entity or liabilities.

- Stock Purchase: The buyer acquires the entire legal entity, including all assets, liabilities, and contracts, as-is.

Quick Highlights:

- Buyers favor asset purchases for liability protection and tax benefits (like resetting the tax basis of assets for depreciation).

- Sellers prefer stock purchases for simpler transactions and lower taxes (usually taxed at long-term capital gains rates).

- Asset purchases often require retitling assets and renegotiating contracts, while stock purchases typically allow contracts and permits to transfer automatically.

Key Takeaway: Asset purchases work well for smaller deals or when liability risks are high. Stock purchases are better for seamless transitions and maintaining business continuity. Both options have pros and cons depending on your goals.

Asset Purchases vs Stock (Equity) Purchases in Business Acquisitions

sbb-itb-a3ef7c1

What Is an Asset Purchase?

An asset purchase happens when a buyer acquires specific assets and selected liabilities from a seller's business, while the legal entity remains with the seller. This approach allows the buyer to pick and choose the assets they want - such as equipment, inventory, customer lists, intellectual property, or goodwill - without taking on the entire business entity.

"In an asset purchase, the buyer acquires the core operating assets - equipment, inventory, customer lists, trade names, goodwill - while leaving the seller's corporate shell and its potential liabilities behind." - Robbie Crosier, M&A Attorney

The seller keeps ownership of the legal entity and is responsible for winding it down or liquidating any remaining parts. This structure differs from a stock purchase, where the buyer takes over the entire company, including its history, contracts, and any hidden risks.

Since individual assets are transferred, contracts, leases, and permits must also be individually reassigned. This often requires third-party consent or renegotiation, which can slow things down. Employees are typically terminated by the seller and rehired by the buyer, and physical assets like vehicles or real estate need to be retitled. These steps highlight the unique complexities of asset purchases.

Key Features of Asset Purchases

The standout feature of an asset purchase is selectivity. Buyers can choose the assets they want and avoid liabilities they don’t. This allows them to acquire the profitable parts of a business while steering clear of issues like unpaid debts, lawsuits, or underperforming segments.

"An asset deal is like an open box of toys: You get to pick and choose what you want." - Hallam Stanton

Assets commonly acquired include tangible items like machinery, inventory, and real estate, as well as intangible ones like patents, trademarks, customer lists, and goodwill. On the other hand, buyers typically don’t acquire the seller’s cash, accounts receivable, or investments. Most importantly, they avoid contingent liabilities - hidden risks such as unresolved employee disputes, customer complaints, or undisclosed debts that could surface later.

However, this flexibility comes with challenges. Because assets are transferred from one entity to another, third-party consents become crucial. Many contracts, leases, and permits include "anti-assignment" clauses requiring explicit approval for transfer, which can delay the process.

When Are Asset Purchases Commonly Used?

Asset purchases are especially popular for transactions under $50 million, particularly in the Main Street and lower middle markets. Buyers in these markets often prioritize minimizing liability risks over simplifying the deal, making asset purchases a preferred choice.

This structure is also common when acquiring a specific division of a larger company. A great example is IBM's 2016 acquisition of The Weather Company's product and technology businesses - including weather.com and mobile apps - for approximately $2 billion. IBM used an asset purchase to focus on acquiring the data technology for its Watson engine, while leaving out The Weather Company's declining television business, which didn’t align with IBM’s goals.

Asset purchases are also favored when acquiring distressed businesses with high liability risks or when buying sole proprietorships and partnerships, which don’t have stock to sell. Additionally, this structure can sometimes sidestep issues with minority shareholders who refuse to sell their shares.

Next, we’ll dive into how asset purchases compare to stock purchases, highlighting the unique benefits and challenges of each approach.

What Is a Stock Purchase?

A stock purchase happens when a buyer acquires all the stock of a company. Instead of picking specific assets, the buyer takes over the entire legal entity - assets, liabilities, contracts, and even its history - all included. This method stands in contrast to an asset purchase, where only selected assets are transferred.

"The business entity remains intact, and the buyer steps into the seller's shoes as the new owner." - Robbie Crosier, M&A Attorney

In a stock purchase, the company is transferred "as is", meaning the buyer inherits everything, including any liabilities, whether they are obvious or hidden.

"A stock purchase is more simplistic conceptually compared to an asset purchase transaction. The acquiring company purchases the stock of the target entity and assumes the target company as it finds it." - Francine E. Love, Founder & Managing Attorney, LOVE LAW FIRM, PLLC

Because of this, thorough due diligence is critical. Using a business acquisition checklist can help ensure no liabilities are overlooked. The buyer needs to fully understand all liabilities that come with the purchase. Let’s look at what sets stock purchases apart from asset purchases.

Key Features of Stock Purchases

The standout feature of a stock purchase is that the legal entity stays intact. This means:

- Employees remain with the company.

- Vendor and customer relationships continue without disruption.

- Contracts, leases, permits, and service agreements stay in effect without needing new approvals or renegotiations.

Stock purchases are especially advantageous when it comes to licenses and permits that are non-transferable. For example, businesses with important government authorizations or contracts containing anti-assignment clauses can benefit from this structure. However, buyers should note that they inherit the seller’s tax basis in the company’s assets, which could limit future depreciation deductions.

For sellers, stock sales often come with a tax advantage. Profits from these transactions are typically taxed at the long-term capital gains rate, capped at 20% at the federal level.

When Are Stock Purchases Commonly Used?

Stock purchases are a go-to option when business continuity is crucial. Buyers often choose this structure when the target company has essential contracts, licenses, or permits that are difficult - or even impossible - to transfer to a new entity. Sellers also favor stock purchases for their simplicity and the potential for favorable tax treatment.

This approach is particularly effective for companies with established customer relationships, long-term vendor agreements, or specialized regulatory approvals that are hard to replicate. However, it’s not an option for sole proprietorships or partnerships, as these types of businesses don’t issue stock.

One important consideration for buyers is the presence of "change of control" clauses in key contracts. These clauses might require third-party consent, even if the legal entity remains unchanged. To address this, some parties opt for a Section 338(h)(10) election, which allows the deal to be structured as a stock sale but treated as an asset sale for tax purposes.

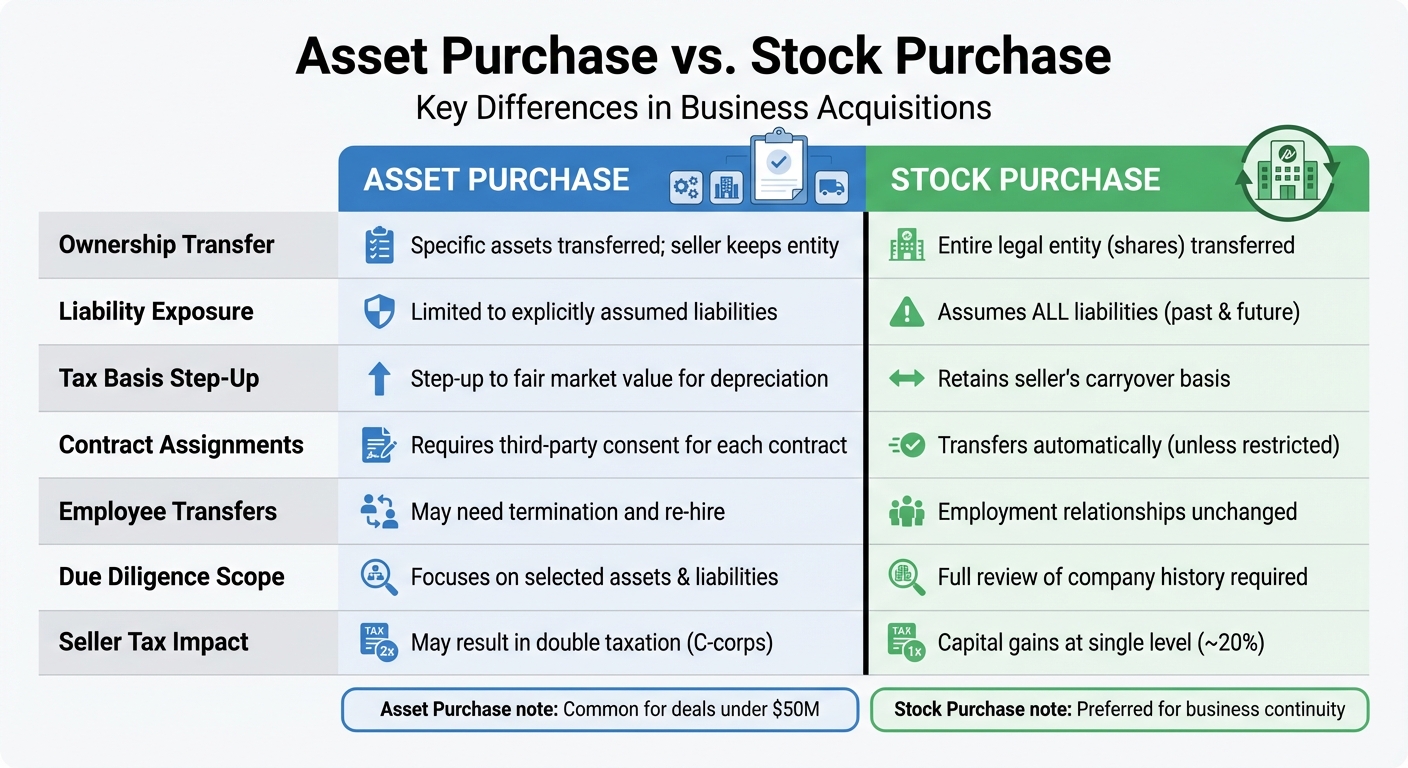

Asset Purchase vs. Stock Purchase: Side-by-Side Comparison

Asset Purchase vs Stock Purchase: Key Differences Comparison Chart

When deciding how to structure a business acquisition, knowing the differences between an asset purchase and a stock purchase can have a big impact on your strategy, costs, and risk management.

As explained earlier, an asset purchase involves buying specific assets like equipment, inventory, or goodwill, while the seller keeps the corporate entity. In contrast, a stock purchase transfers ownership of the company’s shares or membership units, making the buyer the new owner of the entire business, including its legal structure.

This difference has significant implications for liability, taxes, and operational processes. For instance, an asset purchase creates a "liability shield" for the buyer, who only takes on liabilities explicitly agreed upon in the purchase terms. On the flip side, a stock purchase means inheriting all liabilities - whether they're known, unknown, or contingent - because the legal entity remains intact. This is why many smaller transactions (under $50 million) are structured as asset sales, helping buyers avoid surprises down the road.

Here’s a quick breakdown of the key distinctions:

Comparison Table: Asset Purchase vs. Stock Purchase

| Factor | Asset Purchase | Stock Purchase |

|---|---|---|

| Ownership Transfer | Specific assets are transferred; seller keeps the entity | Entire legal entity (shares) is transferred |

| Liability Exposure | Limited to liabilities explicitly assumed | Assumes all liabilities, past and future |

| Tax Basis Step-Up | Allows a step-up to fair market value for depreciation | Retains the seller's carryover basis |

| Contract Assignments | Often requires third-party consent for each contract | Typically transfers automatically unless restricted |

| Employee Transfers | Employees may need to be terminated and re-hired | Employment relationships usually remain unchanged |

| Due Diligence Scope | Focuses on selected assets and liabilities | Requires a full review of the company’s history |

| Seller Tax Impact | May result in double taxation (for C-corporations) | Usually taxed as capital gains at a single level |

Understanding these differences is crucial for structuring a deal that aligns with your goals while managing risks effectively. Each approach has its pros and cons, depending on the specifics of the transaction.

Pros and Cons of Asset Purchases

The structure of an asset purchase doesn’t just shape tax and liability outcomes - it also impacts how smoothly the transaction and subsequent operations unfold. While asset purchases offer buyers benefits like liability protection and tax perks, they can create financial and logistical hurdles for sellers.

Advantages for Buyers

One of the biggest perks for buyers in an asset purchase is protection from liabilities. Since you’re not taking on the seller's corporate entity, you avoid risks tied to past disputes, claims, or other hidden issues. As M&A attorney Robbie Crosier explains:

"In an asset purchase, the buyer acquires the core operating assets... while leaving the seller's corporate shell and its potential liabilities behind. You are essentially taking the 'guts' of the business and starting with a clean slate."

Another major plus is the tax advantage. Buyers get a step-up in the tax basis to fair market value, which means new depreciation and amortization deductions. This reduces taxable income and can improve cash flow. For example, goodwill can be amortized over 15 years, and under current tax laws, you may qualify for 100% first-year bonus depreciation on many tangible assets (though this excludes buildings and most intangible assets).

Buyers also have the freedom to cherry-pick assets. Want the equipment and client lists but not the uncollectible receivables? You can selectively acquire what you need and leave behind unwanted liabilities. This flexibility can make asset purchases especially appealing.

But while buyers enjoy these benefits, sellers often face a tougher set of challenges.

Disadvantages for Sellers

Sellers, particularly those operating as C-corporations, often grapple with double taxation in asset purchases. Here’s how it works: the corporation pays taxes on the gains from selling its assets, and then shareholders pay taxes again when those proceeds are distributed as dividends. Robbie Crosier puts it this way:

"In an asset sale, especially for a C-Corporation, the business faces double taxation: the corporation first pays tax on the sale of its assets, and the owner then pays tax again when those proceeds are distributed to them as a dividend."

Additionally, sellers often face higher tax rates on hard assets, thanks to depreciation recapture. Unlike stock sales, where the buyer takes on all liabilities, sellers in asset purchases are left holding the corporate shell, along with any undisclosed or contingent liabilities.

Operational Challenges

Beyond the tax and liability concerns, asset purchases can be administratively demanding. Every asset - whether it’s equipment, real estate, intellectual property, or vehicles - must be individually transferred and retitled. This process can be time-consuming and complex.

A significant hurdle is dealing with third-party consents. Many contracts, leases, and permits include anti-assignment clauses, which require approval from landlords, vendors, or customers before a transfer can occur. Without early due diligence on these agreements, delays are almost guaranteed.

Transfer taxes on tangible assets can also add to the seller's burden. In more complex transactions, parties sometimes turn to strategies like an F-Reorganization or a Section 338(h)(10) election. These methods aim to balance the buyer’s tax and liability benefits with stock sale treatment for the seller, though they require careful planning.

In short, while asset purchases offer clear advantages for buyers, they often come with significant challenges for sellers, particularly in terms of tax implications and administrative workload.

Pros and Cons of Stock Purchases

Stock purchases tend to favor sellers more than buyers, offering sellers a smoother exit and better tax outcomes. However, buyers face unique challenges, which are explored below.

Advantages for Sellers

M&A attorney Robbie Crosier highlights one of the biggest advantages for sellers:

"For the seller, this is the cleanest possible break. The entire company, including all its assets and - crucially - all its liabilities (both known and unknown), is transferred to the buyer."

This means sellers can walk away without worrying about lingering liabilities or future legal complications.

Tax benefits are another major perk. Sellers often enjoy a single layer of taxation at long-term capital gains rates, typically capped at 20% for high-income earners. This is far more favorable than the tax burden of an asset sale, especially for C-Corporations. In an asset sale, taxes can climb to an effective rate of about 67%, factoring in corporate tax (21%) and shareholder-level capital gains tax (20%). By contrast, stock sales keep the tax rate closer to 20%. Attorney Steve Lewicky explains:

"The fundamental tax benefit of a stock sale lies in its single-level taxation at preferential capital gains rates."

Operationally, stock sales are much simpler. There’s no need to re-title individual assets, rehire employees, or handle depreciation recapture. Sellers also avoid the hassle of obtaining third-party approvals for contract assignments, as the business entity itself remains unchanged.

Disadvantages for Buyers

For buyers, stock purchases come with considerable risks. The biggest challenge is assuming all liabilities - both visible and hidden. These could include unpaid taxes, ongoing litigation, or employee disputes. Francine E. Love, Founder and Managing Attorney at Love Law Firm, points out:

"The buyer will need to conduct a lengthier due diligence process with a stock purchase due to the inherently higher degree of risk associated with assuming potentially unanticipated liabilities."

Another drawback is the inability to adjust the tax basis of the acquired assets. Buyers inherit the seller's tax basis, which limits future depreciation and amortization deductions. In an asset purchase, buyers can "step up" the basis, unlocking deductions like amortizing goodwill over 15 years. With a stock purchase, buyers must take on all assets and liabilities, even those they might prefer to exclude.

To address these risks, buyers often negotiate seller indemnifications to cover pre-closing liabilities. They may also explore a Section 338(h)(10) election, which treats the deal as an asset sale for tax purposes while retaining the legal simplicity of a stock sale.

Operational Benefits

One of the key advantages of a stock purchase is operational continuity. Since the legal entity remains intact, contracts, leases, permits, and licenses usually transfer automatically. This eliminates the need for third-party approvals and ensures business operations continue without interruption. Francine E. Love explains:

"Generally, the contracts the target company has, including leases and any applicable permits, automatically transfer to the buying party. This makes it a more efficient and streamlined... process than an asset purchase."

Additionally, employees stay under their current terms, avoiding disruptions to staffing. The business keeps its Federal Employer Identification Number (FEIN), registrations, and bank accounts, ensuring payroll and cash flow remain uninterrupted. For companies reliant on hard-to-transfer contracts or permits, a stock purchase may be the only practical choice.

Tax Implications for Buyers and Sellers

Taxes can make or break the profitability of a deal. The choice between an asset purchase and a stock purchase has a major impact on taxes, and both buyers and sellers need to fully understand the consequences. These tax considerations often influence the structure of a transaction, shaping strategies and outcomes for both parties.

Tax Benefits for Buyers

When it comes to tax advantages, asset purchases are a clear winner for buyers. One major perk is the step-up in basis, which allows buyers to reset the tax basis of acquired assets to their current fair market value. This is a big deal because it provides significant tax savings. As M&A attorney Robbie Crosier points out:

"In an asset purchase, the buyer can 'step up' the tax basis of the acquired assets to their current fair market value... This tax benefit is not available in a stock purchase, where the old, lower asset basis simply carries over."

This step-up translates into larger depreciation and amortization deductions, which can save a lot of money over time. For example, a $500,000 step-up for a corporation in the 21% tax bracket could result in roughly $105,000 in tax savings over the asset's life. Additionally, buyers can amortize goodwill (the extra amount paid over the value of tangible assets) over 15 years on a straight-line basis. Attorney Steve Lewicky explains:

"The present value of goodwill amortization tax savings often justifies paying a higher purchase price."

Buyers also benefit from options like bonus depreciation or immediate expensing under Sections 168 or 179 for qualifying assets, which can boost cash flow by accelerating deductions in the early years after the purchase. Another plus? Asset purchases shield buyers from inheriting hidden tax liabilities or unresolved tax issues that would come with a stock purchase.

On the other hand, stock purchases offer limited tax perks for buyers. In this case, the buyer takes on the seller's historical tax basis, which restricts future depreciation deductions. However, there is a silver lining: valuable tax attributes like Net Operating Losses (NOLs) or tax credit carryforwards may transfer to the buyer, though they are subject to limitations under IRC Sections 382 and 383.

Next, let’s explore how these tax considerations affect sellers.

Tax Considerations for Sellers

From a seller’s perspective, stock purchases are far more appealing due to their single-layer taxation at the shareholder level. If the stock has been held for over a year, the profit is taxed at long-term capital gains rates, which max out at 20% for high-income earners. This is a much lighter tax burden compared to an asset sale.

For sellers structured as C-corporations, asset sales are particularly taxing - literally. These transactions involve double taxation: the corporation pays tax on the gain from selling the assets at the 21% corporate tax rate, and then shareholders face another tax when the proceeds are distributed as dividends. As CLA Connect explains:

"A stock transaction is often highly desirable for the selling shareholders because it results in one layer of taxation (by the shareholders) and avoids double taxation that occurs with asset sales by C corporations."

The combined federal tax burden for a C-corporation asset sale can reach an effective rate of around 67%, factoring in both corporate and shareholder taxes. By comparison, a stock sale typically results in a tax rate closer to 20%.

Asset sales also come with depreciation recapture, where prior depreciation is taxed as ordinary income - up to 37% (or 25% for real estate). While pass-through entities like S-corporations and partnerships avoid double taxation, they still face less favorable tax treatment in asset sales due to depreciation recapture and the mix of ordinary income and capital gains.

To navigate these tax differences, sellers should calculate the after-tax proceeds for both structures early in the negotiation process. If a buyer insists on an asset purchase to gain step-up benefits, sellers can negotiate for a higher price to offset their increased tax burden. Another option is a Section 338(h)(10) election, which treats the deal as an asset sale for tax purposes while keeping the legal simplicity of a stock sale.

Due Diligence and Legal Considerations

Grasping the nuances of due diligence is essential when tackling the legal and operational hurdles of asset and stock purchases. The depth and focus of due diligence differ significantly between these two approaches, and understanding these distinctions can help both buyers and sellers prepare for the process and sidestep unexpected issues during closing.

Due Diligence in Asset Purchases

In an asset purchase, the due diligence process is targeted and precise. Buyers concentrate on confirming ownership of specific assets and identifying the liabilities they’ll be taking on. This approach serves as a shield against liabilities, ensuring buyers are not held accountable for claims tied to the seller's entity before the transaction.

However, this comes at a cost: asset purchases involve a lot of administrative work. Many agreements include "anti-assignment" clauses, meaning buyers must secure third-party consents to transfer certain assets. If these consents aren’t obtained in time, it can delay the closing process.

Operationally, buyers also face tasks like retitling assets, updating intellectual property filings, and even rehiring employees under the new entity. Take the case of Harney Capital in November 2025: they highlighted how, for a software company with hundreds of customer subscriptions, an asset purchase would require renegotiating every individual client contract. This kind of administrative load often makes stock purchases a more practical choice.

While asset purchases focus on verifying specific assets and navigating consent requirements, stock purchases demand a much broader investigation into the entire entity.

Due Diligence in Stock Purchases

Stock purchases require a thorough review of the entire company. Since the buyer acquires the legal entity as a whole, they must assess its complete history, including corporate records, contractual commitments, and any existing or potential liabilities. Francine E. Love, founder of Love Law Firm, explains:

"Generally speaking, the buyer will need to conduct a lengthier due diligence process with a stock purchase due to the inherently higher degree of risk associated with assuming potentially unanticipated liabilities."

The primary concern? Hidden liabilities. These could include unresolved employee disputes, customer complaints, or regulatory issues that the buyer unknowingly inherits. To mitigate these risks, buyers often request sellers to indemnify them against pre-closing liabilities. Additionally, they need to carefully examine contracts for "change of control" provisions, which may still demand third-party consent despite the entity itself remaining intact.

The advantage of stock purchases lies in their simplicity. Contracts, licenses, and permits usually stay with the entity, eliminating the need for individual transfers. This makes stock deals especially appealing for companies with intricate contractual arrangements that would be challenging to reassign.

Here’s a quick comparison of the due diligence requirements for asset and stock purchases:

| Feature | Asset Purchase Due Diligence | Stock Purchase Due Diligence |

|---|---|---|

| Scope of Review | Targeted: Specific assets and assumed liabilities | Broad: Entire entity history and all liabilities |

| Risk Profile | Lower: Buyer picks "clean slate" assets | Higher: Buyer inherits hidden liabilities |

| Contract Review | Focus on assignability and obtaining new consents | Focus on "change of control" restrictions |

| Time Requirement | Shorter for due diligence, but longer for closing paperwork | Longer for due diligence due to comprehensive risk assessment |

How Clearly Acquired Can Help

Navigating the decision between an asset purchase and a stock purchase can feel like a maze of financial, legal, and operational considerations. That's where Clearly Acquired steps in. This AI-powered platform is tailored for Main Street to Lower-Middle-Market transactions, making the process smoother for both buyers and sellers. Whether you're buying your first business or planning an exit, Clearly Acquired combines deal sourcing, advisory services, and financing into one seamless experience.

For buyers, the platform offers tools to simplify decision-making. With access to verified deal flow and AI-driven financial analysis, you can determine which purchase structure - asset or stock - best fits your goals. The Deal Hub serves as a central location for managing transactions, featuring secure data rooms to store financial statements, contracts, and due diligence documents. Achieving "Clearly Verified" status unlocks instant access to seller financials and supporting data, saving time and ensuring transparency.

For sellers, Clearly Acquired streamlines the exit process. The platform provides AI-powered business valuations and an exit readiness analysis, helping you prepare your business for sale - whether it's an asset or stock transaction. It also simplifies buyer screening and coordinates debt, equity, and transition planning to ensure a smoother closing process.

On the financing side, Clearly Acquired uses advanced underwriting to match your transaction with the right lenders. Whether you're looking for SBA 7(a) loans vs. other financing options, such as conventional financing or structured equity, the platform connects you with capital sources that align with your deal's criteria. Secure financial verification through Plaid accelerates lender approvals, making the process faster and more efficient. Plus, new users can get verified for free and take advantage of a 3-day trial to explore all the platform's features.

Key Takeaways

The choice between an asset purchase and a stock purchase carries significant implications for tax obligations, liabilities, and how smoothly operations continue after the deal closes. Eric Welchko, President of Harney Capital, puts it succinctly:

"Choosing between an asset and stock sale isn't a legal formality – it's a strategic decision that shapes your outcome".

This decision directly impacts everything from the taxes you'll pay to the cash you walk away with after the deal is done.

Asset purchases allow buyers to pick and choose specific assets while steering clear of unwanted liabilities. One major benefit is the tax "step-up" to fair market value, which can lead to higher depreciation deductions down the line. However, for sellers operating under a C-corporation, this structure can result in double taxation, with effective tax rates climbing as high as 67% on the gain. These purchases are often preferred in smaller deals, such as Main Street or lower-middle-market transactions, as they help protect buyers from inheriting legacy liabilities.

Stock purchases, on the other hand, tend to favor sellers. They provide a cleaner exit with a single level of capital gains tax - typically around 20% - and minimal disruption to operations since contracts and permits usually stay in place. Buyers, however, acquire the entire legal entity, including its liabilities, so conducting thorough due diligence is critical. While the carryover tax basis offers fewer immediate tax advantages, stock transactions are often simpler, with less paperwork and fewer approvals from third parties.

Given these contrasts, it's essential to carefully weigh both options before moving forward. Before signing a Letter of Intent (LOI), it's wise to model each structure to understand the actual after-tax proceeds. You can also use a business valuation calculator to estimate your company's worth before modeling these scenarios. For instance, a higher purchase price in an asset sale could still leave you with less cash than a lower-priced stock deal once taxes are considered. Engaging tax and legal advisors early in the process - ideally at the LOI stage - can help address structural differences. In some cases, hybrid strategies like Section 338(h)(10) elections can align the preferences of both buyers and sellers.

Ultimately, understanding the trade-offs between these structures is key to maximizing value and avoiding unexpected pitfalls. Whether you're buying your first business or planning your exit, choosing the right structure - backed by solid due diligence and expert guidance - can be the difference between a deal that works in your favor and one that falls short.

FAQs

Which deal structure closes faster?

When it comes to closing deals, stock purchases tend to move faster than asset purchases. Why? In a stock purchase, the entire company changes hands in one transaction, simplifying the process. On the other hand, asset purchases require a detailed review and transfer of each individual asset, which naturally takes more time and effort.

How do you decide between asset vs. stock for taxes?

When deciding between an asset purchase and a stock purchase, tax considerations and liability management play a big role.

Asset purchases let buyers pick and choose which assets and liabilities they want to acquire. This often comes with tax perks, like the ability to depreciate or amortize the assets, which can reduce taxable income over time.

Stock purchases, on the other hand, involve taking over the entire company, including all its liabilities. While this might grant access to the company’s existing tax benefits, it also means inheriting all its obligations, which could be a risk.

To make the best choice for your financial goals, it’s wise to consult a professional who can navigate the specifics of your situation.

What liabilities can follow you in an asset purchase?

In an asset purchase, some liabilities can still follow the buyer. These include contingent liabilities such as unresolved legal claims, environmental responsibilities, or debts that aren’t explicitly excluded in the purchase agreement. To minimize these risks, it’s crucial to thoroughly review the agreement and perform detailed due diligence.

%20%20Process%2C%20Valuation%20%26%20Legal%20Checklist.png)

%20in%20a%20%2420M%20Sale..png)

%20vs.%20Conventional%20Loans%20for%20business%20acquisition.png)

.png)

.png)

.png)

.png)