Selling a $20 million business is a complex process that requires expertise in valuation, buyer identification, and deal negotiation. Investment banks play a key role by managing every step, ensuring the seller gets the best outcome. Their responsibilities include:

- Valuation: Cleaning up financials, adjusting for market standards, and highlighting true profitability.

- Marketing: Creating detailed documents like the Confidential Information Memorandum (CIM) to attract serious buyers.

- Buyer Outreach: Reaching out to 150–300 potential buyers, narrowing them down to serious contenders, and building competition.

- Negotiation: Structuring deals, managing terms, and maximizing sale prices through competition.

- Fee Structure: Typically, banks charge 4–5% of the sale price as a success fee, alongside a retainer.

Investment banks often increase sale prices by 6% to 25%, making their involvement highly impactful. The process usually takes 6–9 months and involves pre-marketing, outreach, due diligence, and finalizing the deal. Choosing the right bank - whether a specialist or generalist - depends on your industry and goals. With the right partner, sellers can secure a smooth process and higher returns.

What do Investment Banks actually do? | The M&A process explained

sbb-itb-a3ef7c1

What Investment Banks Do in a $20M Sale

When it comes to managing a $20 million sale, investment banks play a pivotal role in streamlining the process. Their job? Handle the heavy lifting in three key areas: preparing your financials, finding the right buyers, and negotiating the deal. Let’s break down how they do it.

Valuation and Financial Preparation

The first step is getting your financials in top shape. Investment banks dive into your records to clean things up - removing one-time expenses, adjusting owner compensation to align with market standards, and cutting out discretionary spending. Why? To uncover your business’s true sustainable cash flow (EBITDA), which is the metric buyers focus on when determining their offers.

They also conduct a Quality of Earnings (QofE) review to ensure revenue recognition, reserves, and compliance with GAAP standards are all in check. From there, they build detailed financial models - covering your Income Statement, Balance Sheet, and Cash Flow statements. These models aren’t just about numbers; they’re designed to validate forecasts and highlight what makes your business valuable. For instance, they might include insights like revenue by product line, customer retention trends, or profit margins by market segment.

"The objective is not to transform the business, but to address the potentially unattractive issues that may limit interest or value."

– Michael Benson, Managing Director, Stout

Market Positioning and Buyer Outreach

Once the financials are polished, it’s time to tell your business’s story. Investment banks create a Confidential Information Memorandum (CIM) - a detailed document, often 30 to 50 pages long, that showcases your company in the best possible light. This narrative is key to attracting buyers.

Next, they identify potential acquirers, dividing them into two main groups: Strategic Buyers, like competitors or companies in related markets looking for synergies, and Financial Buyers, such as private equity firms or family offices prioritizing cash flow and growth.

The outreach process is methodical. It starts with an anonymous one-page "teaser" to gauge interest without revealing your company’s identity. If a buyer shows interest and signs a Non-Disclosure Agreement (NDA), they gain access to the full CIM. This step-by-step approach ensures you only engage with serious, qualified buyers.

With interested parties lined up, the focus shifts to creating competitive dynamics that can maximize your deal’s value.

Negotiation and Deal Structuring

Negotiations are where investment banks truly shine. Their goal? Create competition among buyers to push up the sale price and secure better terms. They guide discussions around the Letter of Intent (LOI), ironing out critical points like working capital targets, indemnification limits, and escrow holdbacks - all before the exclusivity period begins, when your leverage starts to wane.

They also structure the deal to balance cash payments, earn-outs (performance-based payouts), and seller notes. If your company has raised capital in the past, they’ll navigate complex cap table waterfalls to ensure sale proceeds are distributed correctly among shareholders, debt holders, and tax authorities. And if you plan to stay involved with the business post-sale, they’ll negotiate terms to protect that future relationship.

The entire process, from start to finish, typically takes four to six months. Throughout, investment banks coordinate every detail to keep things running smoothly and on schedule.

How Investment Banks Increase Sale Price

Investment banks are skilled at driving up sale prices by using their negotiation expertise and creating an environment of urgency and competition. They also have a knack for identifying unexpected buyers who might be willing to pay a premium.

Creating Competition Among Buyers

Investment banks excel at narrowing down a large pool of potential buyers into a select group of serious contenders. By managing multiple conversations simultaneously, they create a competitive atmosphere where buyers feel pressured to put forth their best offers early on.

To maintain momentum, bankers set strict deadlines for submitting Indications of Interest (IOIs) and Letters of Intent (LOIs). This strategy not only speeds up buyer commitments but also prevents any single buyer from gaining undue leverage or stalling negotiations. Even after selecting a lead bidder, bankers keep secondary bidders in play as a backup plan. This ensures that if the primary deal falls apart during due diligence, there's an immediate alternative, keeping all parties motivated and transparent.

"Competition disciplines and clears the market at best price."

– Ryan Kuhn, Founder, Kuhn Capital

Another essential tactic is standardizing different offer structures for easy comparison. By breaking down elements like cash at closing, earn-outs, and equity rollovers into a unified metric, bankers can identify the true highest-value offer. This benchmark is then used to push competing bidders higher. The mix of strategic buyers, who seek synergies, and financial buyers, such as private equity firms with $2.4 trillion in available capital as of mid-2023, further intensifies the competition.

Finding Non-Obvious Buyers

Investment banks don’t stop at obvious competitors; they dig deeper to find buyers in related industries who might see unique value in your business. Using analytical tools and proprietary databases, they identify companies that would benefit from specific aspects of your business - whether it’s a niche customer base, unique technology, or geographic footprint.

During internal due diligence, bankers uncover hidden strengths within your business, like fast-growing customer segments, high-margin product lines, or standout market positioning. They then craft the Confidential Information Memorandum (CIM) to highlight these unique assets, drawing premium offers. This approach complements the competitive bidding process and often leads to better outcomes. On average, businesses represented by investment banks achieve EBITDA multiples 1.5 times higher than those that go it alone, with sellers enjoying valuation premiums of about 25%.

Persistence is key. Bankers follow up with large corporations where M&A decision-making might be spread across multiple departments, ensuring your opportunity lands in front of the right people.

Investment Bank Fees for $20M Deals

When selling a business valued at $20 million, understanding investment bank fee structures is essential. These fees typically combine an upfront retainer with a success-based payment, ensuring both parties are committed to closing the deal.

Success Fees and Retainers

For deals in the $20 million range, investment banks usually charge success fees between 4% and 5% of the enterprise value. This means you can expect to pay $800,000 to $1,000,000 upon closing the transaction. The success fee, which represents the bulk of the bank's compensation, is only due when the sale is finalized.

In addition to success fees, most banks require a retainer fee for deals under $100 million. These retainers typically range from $50,000 to $150,000, with many banks opting for monthly payments of $5,000 to $15,000. Retainer fees are usually credited against the final success fee. For example, if you pay a $50,000 retainer and the success fee totals $800,000, you’ll owe a net amount of $750,000 at closing.

Many middle-market investment banks also enforce a minimum success fee, often between $500,000 and $700,000, regardless of the final sale price. This ensures they are compensated fairly for their work, even if the transaction doesn't meet initial expectations.

"The retainer should typically be enough to feel it, but not enough to hamper cash flows and break the bank."

– Foresight Investment Banking

These fees not only cover the upfront costs of preparing for the sale but also establish clear incentives for bankers to deliver results.

How Fee Structures Align Incentives

Investment banks design their fee structures to align their goals with yours. By tying the bulk of their compensation to the success fee, which is only paid upon closing, banks are motivated to secure the best possible deal for you.

Some banks use accelerator fee models to further strengthen this alignment. Instead of charging a flat percentage, they increase the percentage for proceeds above a set threshold. For instance, they might charge 4% on the first $20 million and 6% to 10% on any amount beyond that. This incentivizes the banker to aim for a premium sale price.

The retainer also plays a critical role beyond covering initial expenses, such as preparing the Confidential Information Memorandum. It demonstrates your commitment to the sale, ensuring the bank dedicates its time and resources to your transaction.

"The success fee (not the retainer) should always be the most significant component of the total compensation... to incentivize investment bankers and to align their interests with your own."

– Divestopedia Team

To maintain focus throughout the process, consider negotiating monthly retainer payments instead of a large upfront fee. Additionally, clarify in your engagement letter whether the success fee applies to earnouts, rolled equity, or assumed debt, as these elements can significantly affect the final fee calculation.

Choosing an Investment Bank for Your $20M Sale

Selecting the right investment bank for a $20M sale is a significant decision that requires careful consideration of expertise and compatibility. This partnership isn't just transactional - it's a long-term collaboration, so finding the right fit is crucial.

Start by reviewing their track record. Ask for details on recent transactions in the $10M–$50M range. It's important to choose a bank with experience handling deals of a similar size to your $20M sale.

Make sure you know which senior bankers will be directly involved in your deal. To protect your interests, include a key man provision in your engagement letter to ensure those specific bankers remain part of the process. Additionally, request references from CEOs they've worked with successfully. If they hesitate to provide references, it could be a red flag.

Check that the firm is FINRA-licensed and has strong connections with both strategic and financial buyers. These initial steps will help you determine whether a specialist or generalist investment bank is the better option for your needs.

Specialist vs. Generalist Investment Banks

Choosing between a specialist and a generalist investment bank depends on your industry and the complexity of your business. Specialists offer deep knowledge and relationships within specific sectors, while generalists provide broader networks and resources, often suited for more complex or multi-industry transactions.

| Feature | Specialist Investment Banks | Generalist Investment Banks |

|---|---|---|

| Industry Expertise | In-depth understanding of sector-specific value drivers | Broader expertise across various industries |

| Buyer Networks | Strong connections with niche strategic and institutional buyers | Extensive networks spanning multiple sectors |

| Geographic Reach | Often focused on specific regions or global hubs within a vertical | Larger teams with more international reach |

| Deal Complexity | Ideal for unique technical or financial challenges | Better suited for large, multi-faceted transactions |

For example, Clarke Advisors, LLC has represented over 66 companies in the transportation and logistics sector between 2021 and 2026 through the Axial platform, successfully closing at least 12 deals by leveraging private equity and strategic buyer networks. Similarly, Apogee Equity Partners has worked with at least 12 businesses in the HVAC and plumbing sector since 2023, utilizing a specialized buyer database and partnerships with national consolidators.

"Specialists are intimately familiar with challenges, players, and needs in your industry. These firms are best able to recognize and articulate your distinct advantages that aren't easily replicable."

– Pascal Niedermann, Founding Partner, The Maestro Group

If your industry is highly technical or niche, a specialist may be the best choice. On the other hand, a generalist might be more suitable if your business has broad appeal or if they have dedicated sub-teams focused on your sector.

Once you've narrowed down your options, it's time to dig deeper into evaluation criteria.

What to Look for When Evaluating Investment Banks

The right investment bank can make all the difference in achieving a successful sale. Their experience, team dedication, and approach to your deal are critical factors to consider.

Use the CREATE framework to evaluate candidates: Compatible, Reputable, Expert, Available, Trustworthy, and Experienced. Ask for a list of their 5–10 most recent transactions, and inquire about any deals that didn’t close - and why.

Team capacity is another key consideration. Confirm how many active assignments the deal team is managing to ensure they have the bandwidth to focus on your transaction. Also, verify that the professionals you meet during the pitch will handle the day-to-day execution of your deal.

"If your business is significantly smaller than the banker's typical deal size, you may not get the attention and effort required to be successful."

– Patrick Ungashick, CEO, NAVIX Consultants

Finally, review their fee structures. Be cautious of banks demanding large upfront fees. Instead, prioritize success-based compensation models. You can model different fee structures - whether the Lehman Formula, a flat percentage, or an accelerator - to determine what aligns best with your goals. Before signing, have a deal attorney review the agreement to safeguard against unfavorable terms.

The Investment Banking Process for a $20M Sale

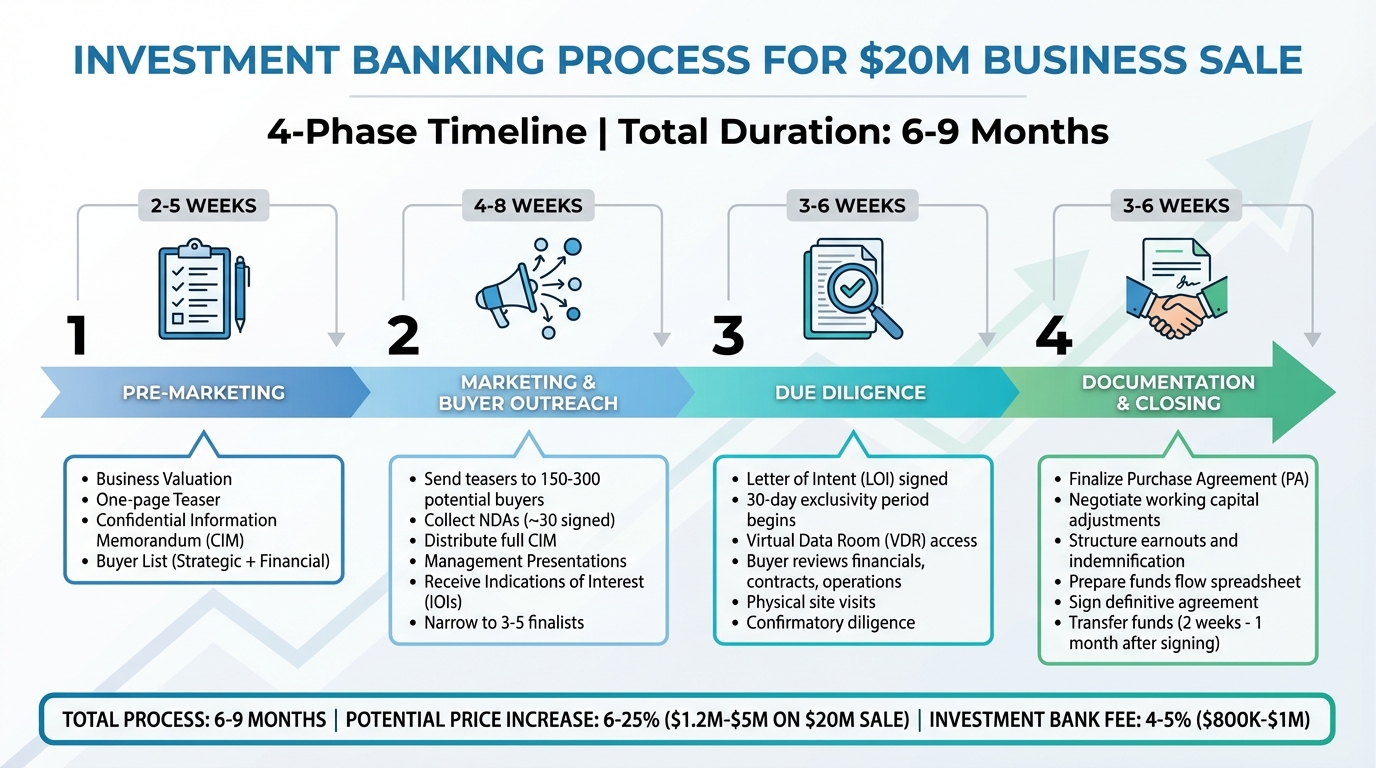

Investment Banking Process Timeline for $20M Business Sale

When selling a business for $20 million, the investment banking process is a structured journey that typically spans 6 to 9 months. This timeline ensures every phase is handled meticulously, minimizing surprises along the way.

The process is divided into four main phases: pre-marketing preparation, active marketing and buyer outreach, due diligence, and final documentation and closing. Each phase includes specific tasks and deliverables, all managed by your investment bank to keep things on track.

| Phase | Duration | Key Deliverables |

|---|---|---|

| Pre-Marketing | 2–5 Weeks | Valuation, Teaser, CIM, Buyer List |

| Marketing | 4–8 Weeks | NDAs, Management Presentations, IOIs |

| Diligence | 3–6 Weeks | Virtual Data Room (VDR) access, Physical visits |

| Documentation/Closing | 3–6 Weeks | Purchase Agreement (PA), Funds Flow, Closing |

During the outreach stage, your banker typically narrows down the pool of potential buyers to around 30 signed NDAs, eventually selecting 3 to 5 finalists for deeper due diligence. Management presentations during the marketing phase are key to refining the buyer list.

Initial Engagement and Business Assessment

The journey begins with your investment bank conducting a preliminary valuation to ensure your pricing expectations align with market realities. This phase also involves identifying and addressing any accounting, legal, or operational issues. For example, non-recurring expenses like personal travel or above-market salaries are adjusted to reflect the business's true profitability.

Two critical documents are created during this stage: a one-page teaser to generate initial interest and a Confidential Information Memorandum (CIM) - a detailed 30–50 page document outlining financials and growth potential. The full CIM is only shared with buyers who sign a Non-Disclosure Agreement (NDA).

Your banker will also prepare a buyer list, including both strategic buyers (competitors and industry peers) and financial buyers (like private equity firms). It's crucial to review this list carefully to flag any parties who might misuse information about the sale to target your customers or partners.

Marketing and Buyer Outreach

Once the marketing materials are ready, your banker initiates confidential outreach to the approved buyer list. The teaser is sent out first, and interested parties must sign an NDA before gaining access to the CIM.

Qualified buyers are then invited to participate in management presentations. These one-hour sessions allow your leadership team to showcase the business and address detailed questions.

Following these presentations, buyers submit Indications of Interest (IOIs) - non-binding proposals that outline a preliminary valuation range and deal structure. This stage acts as a filter, helping you and your banker decide which buyers should proceed to in-person meetings. If a buyer's valuation or strategic fit doesn't align with your goals, there's no need to continue discussions.

By managing this outreach on a tight schedule, your banker creates competitive tension among buyers, which can lead to better valuations and more favorable deal terms. Once the marketing phase wraps up, the process moves into in-depth negotiations and due diligence.

Negotiation, Due Diligence, and Closing

After reviewing the IOIs, you'll select a preferred buyer to sign a Letter of Intent (LOI). This document typically grants the buyer an exclusivity period - usually around 30 days - to finalize the deal. During this time, discussions with other potential buyers are put on hold while the chosen buyer conducts a deeper evaluation.

The buyer's confirmatory due diligence involves accessing a Virtual Data Room (VDR) to review critical documents, such as employee census data, customer contracts, and audited financial statements. Your banker oversees the VDR to ensure confidentiality and clarity.

"Missing or conflicting information is usually perceived as a risk by a potential buyer, and risks will, most likely, lower the deal value."

– Merit Investment Bank

Preparing the VDR in advance can significantly shorten the closing timeline and reduce stress for the seller. Meanwhile, legal teams work on finalizing the Purchase Agreement (PA), addressing complex terms like working capital adjustments, earnouts, and indemnification. Your banker plays a key role in resolving any friction during negotiations to maintain a productive relationship with the buyer.

The process concludes with a funds flow spreadsheet that details exactly how the $20 million, along with any adjustments, will be distributed at closing. Your banker coordinates this final step with your M&A attorney, CPA, and wealth manager to ensure everything goes smoothly. Typically, there's a 2-week to 1-month gap between signing the definitive agreement and the actual transfer of funds.

Conclusion

Selling a business for $20 million is no small feat. It’s a detailed process that requires the right expertise to get the best outcome. This is where investment banks step in, offering not just guidance but also the ability to maximize your sale price, simplify the process, and handle the complex deal structures that are common in mid-market transactions.

Here’s the big picture: investment banks can increase your sale price by 6% to 25%. On a $20 million deal, that means an additional $1.2 million to $5 million in your pocket - far outweighing their success fee. How? By creating competition among buyers, presenting financials in a way that highlights true profitability, and identifying buyers who might pay a premium, even if they’re not the obvious choice.

"Competition disciplines and clears the market at best price."

– Kuhn Capital

But it’s not just about the money. Investment banks also make the entire process smoother. They coordinate with your legal, tax, and accounting teams, freeing you up to continue running your business. Plus, they often take on the tough conversations during negotiations, acting as the "bad cop" when needed. This helps maintain a good relationship with the buyer, which can be crucial during the transition after the deal closes.

The timeline? Typically, it takes 6 to 9 months. From preparing the Confidential Information Memorandum to overseeing due diligence in the Virtual Data Room, investment banks ensure every detail is handled. Their expertise in valuation, buyer engagement, and deal structuring gives you access to resources and insights that most business owners simply don’t have. It’s a level of support that can make all the difference in achieving the best possible outcome.

FAQs

How do investment banks assess the value of a business during a $20 million sale?

Investment banks determine a business's value by diving deep into its financial health, market standing, and future growth opportunities. They meticulously analyze financial statements, adjust earnings to filter out one-time items, and construct detailed financial models to estimate the company's value.

Beyond the numbers, they also examine industry trends, recent comparable deals, and the competitive environment. This thorough process ensures the valuation captures both the company's core worth and current market dynamics, helping sellers achieve the best possible outcome in a transaction.

How do investment banks attract and engage buyers during a $20 million business sale?

Investment banks employ various strategies to connect with and engage potential buyers during a business sale. The process typically begins with identifying a carefully curated list of prospective buyers. This selection is based on thorough market research and a deep dive into industry trends. To spark initial interest, they share teaser documents - short, engaging summaries of the business that highlight its appeal. Once a buyer signs a non-disclosure agreement (NDA), they gain access to more detailed insights through a Confidential Information Memorandum (CIM), all while maintaining strict confidentiality.

To keep buyers engaged, investment banks use personalized outreach and tailored marketing materials that resonate with each target audience. They also create a sense of competition among interested parties, which can help drive up the business’s valuation and secure better terms for the seller. Beyond this, they oversee the negotiation and due diligence phases with precision, ensuring the process remains streamlined and attracts serious, qualified buyers. These tactics play a critical role in delivering successful results for the sellers.

How do investment banks structure their fees to align with a seller's goals?

Investment banks commonly structure their fees to align closely with the seller's goals through a success-based model. This setup typically involves two components: an upfront retainer fee and a success fee. The success fee is only paid once the deal is successfully completed, and it’s calculated as a percentage of the final sale price. This ensures the bank has a strong incentive to maximize the transaction's value.

In some cases, fee agreements include tiered success fees, where the percentage payout increases as the sale price reaches higher thresholds. This structure motivates the bank to aim for the highest possible valuation, aligning their priorities with the seller's. By linking their compensation to the deal's outcome, investment banks stay focused on delivering results that meet the seller’s objectives while minimizing potential risks.

%20in%20a%20%2420M%20Sale..png)

%20vs.%20Conventional%20Loans%20for%20business%20acquisition.png)

.png)

.png)

.png)

.png)