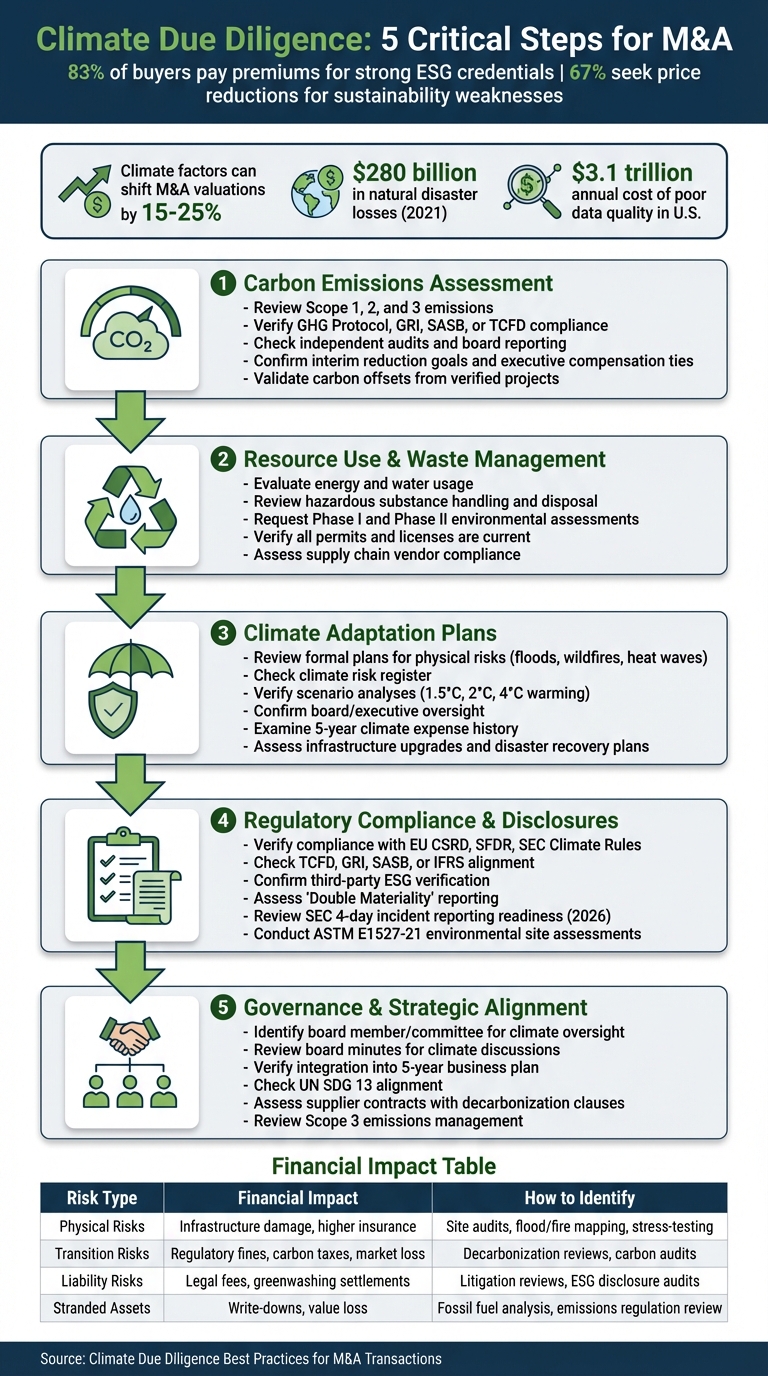

M&A deals are now shaped by climate risks. Buyers are paying premiums for companies with strong ESG practices, while sustainability weaknesses lower valuations. Key risks include:

- Physical risks: Floods, wildfires, and extreme weather.

- Transition risks: Carbon taxes, stricter regulations, and shifting consumer preferences.

To address these, climate due diligence focuses on consultation services and assessing:

- Carbon emissions: Review Scope 1, 2, and 3 emissions, reduction goals, and offsets.

- Resource use: Assess energy, water, and waste management compliance.

- Adaptation plans: Evaluate preparations for climate disruptions like floods or heatwaves.

- Regulatory compliance: Check alignment with frameworks like TCFD and CSRD.

- Governance: Ensure board oversight and integration of climate goals into strategy.

Failing to assess these risks can lead to stranded assets, regulatory fines, or reputational damage. Buyers should prioritize frameworks, scenario testing, and clear governance to secure long-term value.

5-Step Climate Due Diligence Checklist for M&A Transactions

How to Perform M&A Due Diligence on Sustainability | Sarah Thuo w/ Kison Patel

sbb-itb-a3ef7c1

Environmental Risk Assessment

Assessing environmental risks is a key step in understanding how climate factors influence a company’s operations, financial health, and overall viability. When conducting climate due diligence, buyers should focus on three main areas: carbon emissions tracking, resource management, and climate adaptation strategies. Let’s break these down.

Carbon Emissions and Greenhouse Gas Inventory

Start by requesting the target company's most recent emissions reports. These reports should cover all three scopes:

- Scope 1: Direct emissions from the company’s owned or controlled operations.

- Scope 2: Indirect emissions from purchased energy.

- Scope 3: Indirect emissions across the value chain, such as supplier and customer activities.

Find out which framework the company uses for emissions measurement. Common standards include the GHG Protocol, GRI, SASB, and TCFD. It’s equally important to confirm whether these reports are independently audited and submitted regularly to the board.

Check if the company has set interim carbon reduction goals and whether executive compensation is tied to meeting these targets. For carbon offsets, verify that they come from verified projects and that the company prioritizes reducing emissions before purchasing offsets. Additionally, review how many supply chain contracts include clauses requiring decarbonization or climate-related reporting.

Resource Use and Waste Management

Environmental due diligence should also cover how the company handles resources and waste. Evaluate compliance with federal, state, and local environmental laws, especially concerning pollution control and waste management. Request documentation via a secure deal room on hazardous substances, including how they are handled, stored, transported, and disposed of. Don’t overlook off-site storage or disposal locations, as these could reveal hidden liabilities.

Analyze the company’s energy and water usage, along with its reliance on other scarce resources. Ask for Phase I and Phase II environmental assessments, permits, EPA notices, and any records of investigations by public agencies. Confirm that all permits and licenses related to waste disposal or resource extraction are current and won’t be affected by a potential change in ownership.

Supply chain oversight is another critical area. Investigate whether key vendors comply with environmental laws, as their failures could create reputational or operational risks. Reviewing supply chain maps and vendor dependencies may also help identify inefficiencies or resource waste in production.

Climate Adaptation Plans

Once resource use is assessed, shift focus to the company’s preparations for climate-related risks. For mergers and acquisitions, it’s crucial to confirm that the target has a solid climate adaptation strategy. This includes formal plans to address physical climate risks like hurricanes, wildfires, flooding, sea level rise, heat waves, and water shortages.

Request a copy of the company’s risk register to see if it explicitly lists climate-related risks. Also, check whether the company has conducted scenario analyses or stress tests against warming scenarios of 1.5°C, 2°C, and 4°C.

Determine if climate risk management is overseen by a specific board member or executive committee. Ask for data on climate-related expenses over the past five years to understand the company’s historical vulnerabilities. Look for evidence of adaptation measures implemented in the last five years that have reduced exposure to physical risks.

Finally, examine supply chain contracts for clauses addressing climate risks and the company’s ability to renegotiate or terminate agreements if suppliers fail to meet sustainability standards. Investigate whether the company has invested in infrastructure upgrades, disaster recovery plans, or climate-resilient technologies. These investments can reveal how well-prepared the company is for future climate disruptions.

Regulatory Compliance and Climate Disclosures

Navigating regulatory landscapes is essential to understanding climate-related risks in M&A transactions. Utilizing specialized buyer tools can streamline this assessment process. Buyers must assess the disclosure frameworks the target company adheres to and pinpoint any compliance gaps. With environmental risks and mandatory sustainability disclosures playing a bigger role, M&A valuations can shift by 15–25% based on these factors. Below, we break down the key disclosure frameworks and the evolving regulatory risks to consider.

Climate Disclosure Frameworks

Understanding the reporting framework used by the target company is a critical first step. Today, mandatory reporting includes frameworks like the EU CSRD, SFDR, and U.S. SEC Climate Disclosure Rules. For voluntary benchmarks, companies often turn to the Task Force on Climate-related Financial Disclosures (TCFD), Global Reporting Initiative (GRI), Sustainability Accounting Standards Board (SASB), or International Financial Reporting Standards (IFRS).

Be on the lookout for common compliance gaps that could indicate risk. For instance, many companies lack independent third-party ESG verification. Others fail to report comprehensive greenhouse gas emissions, particularly Scope 3 emissions. Another key issue is whether the company aligns with "Double Materiality" standards - reporting not only how climate change impacts the company but also how the company affects the environment. Additionally, confirm if the target maintains a climate risk register and has tested incident response plans that comply with the SEC's four-day reporting rule.

Poor data quality in regulatory filings is a major issue, costing the U.S. economy about $3.1 trillion annually. To mitigate this, ensure the target has strong data retention protocols for climate-related records. These assessments are key to identifying emerging regulatory challenges, especially as we approach the stricter 2026 requirements.

Emerging Regulatory Risks

The shift from voluntary to mandatory disclosure frameworks is accelerating. By 2026, new standards will demand faster reporting, including the SEC’s rule requiring material incidents to be disclosed within four days. Beyond this, emerging risks - like the impact of AI regulations on data governance and labor competition in antitrust reviews - are increasing post-deal liabilities.

Ensure the target meets Hart-Scott-Rodino Act thresholds, which mandate FTC and DOJ pre-merger notifications. Additionally, conduct Phase I and Phase II environmental site assessments under ASTM E1527-21 standards to identify "recognized environmental conditions" that could lead to costly remediation. The EPA warns that inadequate environmental due diligence could result in CERCLA liabilities, even for buyers who acted in good faith.

Governance and Strategic Alignment

Strong governance is the backbone of companies that effectively handle climate risks, setting them apart from those that simply go through the motions. By integrating climate risk management into all levels of the organization, this governance review builds on earlier due diligence focused on environmental risks and regulatory disclosures. When done right, governance doesn't just align strategies but also boosts valuation by reducing hidden liabilities.

Board Oversight and Accountability

A key step is identifying the board member or committee responsible for tracking and reporting on climate risks. Reviewing recent board and committee minutes can provide insight into whether climate change is regularly and thoroughly discussed. It’s also important to see if these risks are tied into the company’s five-year business plan and whether they align with frameworks like UN Sustainable Development Goal 13 (Climate Action).

Another critical area is executive compensation. Check whether pay, employee benefits, or shareholder dividends are tied to meeting emissions-reduction goals or hitting milestones in transition plans. A look at the company’s risk register can also reveal whether both physical and transition climate risks are explicitly addressed.

Supply Chain Climate Risk Management

Once board-level oversight is confirmed, it’s time to dig into supplier contracts and monitoring processes. A strong indicator of commitment is the presence of binding decarbonization clauses in supply chain agreements. Leading companies go further by conducting climate-related due diligence when sourcing goods or services, evaluating the greenhouse gas emissions tied to these contracts. Contracts that include provisions for termination or renegotiation if suppliers exceed carbon footprint thresholds signal serious intent.

Ongoing monitoring and formal audits of vendors are equally important to ensure compliance with environmental standards. This is particularly crucial for addressing Scope 3 emissions - those originating from the value chain - which often make up the largest share of a company’s total carbon footprint. Companies that require suppliers to follow a mitigation hierarchy, focusing on reducing emissions before turning to offsets, demonstrate a higher level of commitment. Additionally, businesses that adopt circular economy principles, such as local sourcing and resource tracking, often showcase stronger supply chain management practices.

For example, in February 2016, Shell finalized its $53 billion acquisition of BG Group, driven largely by BG’s liquefied natural gas assets. Shell integrated these assets into its supply chain as part of its "transition fuel" strategy, aligning with its broader decarbonization and energy transition goals.

This case highlights how managing supply chain climate risks can evolve from being a compliance necessity to becoming a strategic advantage.

Climate Risks and Financial Valuation

Impact on Deal Valuation

Financial models are increasingly factoring in carbon pricing to predict how future emissions regulations might affect profitability. Buyers are also running stress tests on business models using various climate scenarios - such as warming of 1.5°C, 2°C, and 4°C - to evaluate the long-term resilience of assets. During due diligence, it's critical to scrutinize a target company's financial statements for any provisions related to environmental liabilities. Additionally, their risk register should be reviewed to ensure climate-related risks with financial implications are clearly identified.

"83% of M&A buyers would pay a premium for a company with strong ESG credentials, while 67% would seek a price reduction if a target had sustainability weaknesses."

– Mark R. Graham, Private Equity Executive

An example of this shift is Unilever's 2016 acquisition of Seventh Generation, a leader in sustainable product innovation. This move helped Unilever cater to the growing demand for eco-friendly products while aligning its portfolio with trends favoring conscious consumerism. By doing so, Unilever reduced the risk of obsolescence in its home care division.

While deal valuations often reflect short-term market sentiments, the looming threat of stranded assets presents a longer-term financial challenge.

Stranded Assets and Transition Costs

Stranded assets - those rendered obsolete or significantly devalued due to climate-related factors - are among the most pressing financial risks in M&A transactions. These assets can lose value due to regulatory changes, technological advancements, or shifts in consumer behavior, particularly in industries with high energy demands. Transition risks may include increased costs for raw materials, compliance with new regulations, and declining revenues as economies move toward net-zero emissions.

To address these risks during due diligence, specialized questionnaires can be used to gather information on fossil fuel holdings, carbon footprint audits, and the methodologies behind emissions calculations. Reviewing historical climate-related expenditures over the past five years can help establish a baseline for future costs tied to remediation or compliance. Additionally, assessing the target's energy transition strategies can reveal assets that might become stranded.

| Risk Category | Financial Impact on Valuation | Identification Method |

|---|---|---|

| Physical Risks | Damage to infrastructure, higher insurance premiums | Site audits, flood/fire mapping, climate scenario stress-testing |

| Transition Risks | Regulatory fines, carbon taxes, market share loss | Decarbonization plan reviews, carbon audits, regulatory horizon scanning |

| Liability Risks | Legal fees, settlements for "greenwashing" claims | Litigation history reviews, audits of marketing claims and ESG disclosures |

| Stranded Assets | Write-downs, accelerated depreciation, value loss | Fossil fuel exposure analysis, review of asset age vs. emissions regulations |

A notable case is Total's 2016 acquisition of Saft Groupe for $1.1 billion. This deal marked Total's strategic pivot toward clean energy, specifically energy storage solutions. By investing in battery technology, Total mitigated the risk of stranded fossil fuel assets while positioning itself for growth in renewable energy markets.

Another critical consideration is insurance. Certain projects or assets, particularly those in high-risk areas or high-emission industries, may face gaps in insurance coverage. Insurers might withdraw coverage for specific activities or regions due to heightened physical or transition risks, leaving buyers exposed to uninsured liabilities. To address these uncertainties, buyers can explore contractual tools like earn-out clauses - tying part of the purchase price to achieving ESG targets - or Warranty & Indemnity (W&I) insurance to cover unforeseen risks.

Post-Acquisition Climate Integration

Integration of Climate Governance

After an acquisition, bringing together climate governance practices is essential to manage both inherited and new risks under a single, cohesive framework. Start by assigning a dedicated officer to oversee the integration and management of combined climate risks. Without clear ownership, climate initiatives can become fragmented and lose effectiveness.

Begin with a governance gap analysis to compare how the acquiring company and the target handle climate oversight. Use this analysis to align the target’s practices with your own climate strategy. Update your centralized climate risk register to include the target’s physical and transition risks.

Incentivize leadership by tying executive compensation to climate goals. Incorporate climate-related performance indicators into executive pay, bonuses, and employee benefits. This helps ensure that decarbonization targets remain a top priority. Establish clear reporting lines from management to board committees to monitor greenhouse gas emissions and track progress toward net-zero objectives.

Reassess trade association memberships and lobbying activities to confirm they align with your Paris Agreement commitments. Embed decarbonization requirements into contracts with suppliers and customers. Additionally, provide training for the acquired company’s staff to understand how your climate strategy impacts their roles. Transparent communication with all stakeholders is equally important to maintain confidence and trust.

Stakeholder Communication and Transparency

Clear and open communication is key to building trust and avoiding accusations of greenwashing. Use standardized reporting frameworks like TCFD, TNFD, and IFRS to ensure your disclosures are consistent and comparable. Share comprehensive emissions data, covering Scope 1, 2, and 3 greenhouse gas emissions, along with details on methodologies, calculation standards, and any third-party verification.

Review advertising, marketing materials, and product labels to ensure they comply with the latest taxonomy regulations and avoid misleading claims that could lead to legal or reputational risks. Communicate how the low-carbon transition will impact employees, customers, and supply chain partners, and outline strategies for ensuring a just transition and resilience planning. Publish regular impact reports to show progress on your KPIs, and set up formal channels to gather feedback from local communities and customers.

In 2023, Lennox acquired AES, an HVAC and refrigeration company, and leveraged the acquisition to emphasize its sustainability efforts through the AES Reclaim program, which focuses on HVAC recycling and reducing customer carbon footprints.

This example highlights the importance of actions that go beyond press statements. To support these efforts, create a unified ESG budget for the combined entity. Use this budget to fund climate transition initiatives and ensure that new climate policies are communicated swiftly and effectively to employees, suppliers, and contractors.

Conclusion

Climate risk has become a key factor in M&A transactions. Surveys reveal that over 80% of buyers prioritize strong ESG credentials and are willing to pay premiums for them, while 67% push for price reductions when sustainability shortcomings are uncovered. This reflects a clear shift: climate performance now influences deal pricing, financing terms, and the long-term viability of assets.

"To fulfill their fiduciary duties, directors must consider what will maximize shareholder value in the long term. Businesses must account for ESG risks to achieve lasting commercial viability." - Myron Mallia-Dare, Partner, Dentons Canada LLP

This insight highlights the importance of thorough due diligence in addressing climate risks. A rigorous approach helps mitigate threats such as stranded assets, regulatory penalties, and unexpected transition costs. It also enables sellers to showcase their businesses as climate-ready and resilient, which can drive higher valuations. Consider this: natural disasters alone racked up $280 billion in losses in 2021.

Fortunately, standardized tools make this process more manageable. Resources like Climate Change Due Diligence Questionnaires (DDQs) from The Chancery Lane Project provide structured frameworks to evaluate net-zero readiness. Scenario analyses, comparing outcomes under different warming pathways (e.g., 1.5°C versus 4°C), test a business's endurance over time. Additionally, third-party experts can verify emissions data and ensure compliance with shifting regulations. These standardized methods are vital for navigating the complexities of today’s M&A environment.

For buyers and sellers involved in Main Street to Lower-Middle-Market deals, Clearly Acquired offers AI-powered tools and advisory services that simplify due diligence and enhance transaction outcomes. By combining financial analysis, risk assessments, and capital structuring, the platform helps evaluate climate risks alongside traditional M&A factors. Whether you're acquiring a business or preparing for an exit, addressing climate risks early can lead to higher valuations, smoother closings, and stronger long-term performance.

FAQs

What climate risks can most affect M&A valuation?

The biggest climate risks affecting M&A valuation are regulatory changes, physical damage from extreme weather, and a company's capacity to adjust and stay resilient. These issues are particularly pressing in sectors like energy, manufacturing, and real estate. Ignoring these risks can result in liabilities, stranded assets, and lower valuations.

What documents should I request to verify Scope 1, 2, and 3 emissions?

When conducting due diligence, it's essential to request key documents like environmental reports, hazardous material records, remediation histories, permits, compliance records, and any documentation related to legal or regulatory actions. These materials are crucial for thoroughly assessing emissions across Scope 1, 2, and 3 categories.

How can I test if a target’s assets might become stranded?

When evaluating a target's assets, it's crucial to factor in climate-related risks during due diligence. This means gathering climate-specific details, such as net-zero readiness, risk exposure, and plans for adapting to climate challenges. Use targeted questionnaires to obtain this information.

Dig deeper by analyzing areas like potential liabilities, regulatory compliance, and how climate change could affect the value of the assets. Additionally, examine the target’s warranties, indemnities, and strategies for transitioning to a low-carbon future. This comprehensive approach helps pinpoint risks and supports informed decisions to reduce potential financial losses.

%20%20Process%2C%20Valuation%20%26%20Legal%20Checklist.png)

%20in%20a%20%2420M%20Sale..png)

%20vs.%20Conventional%20Loans%20for%20business%20acquisition.png)

.png)

.png)

.png)

.png)