Acquiring a business that generates sustainable and substantial cash flow - imagine $500,000 per year - can transform your financial future. The best part? You don’t need to rely solely on your savings. With the right strategy, you can leverage an SBA loan to fund your acquisition, paving the way to business ownership while minimizing upfront capital investment.

This article breaks down the transformative insights shared by industry experts, Leo Lander, a seasoned M&A advisor, and Matthew Zenner, a top SBA lender at Huntington Bank. Together, their expertise provides a roadmap for entrepreneurs, business buyers, and investors who want to successfully acquire Main Street to lower mid-market businesses using bank financing.

Why Buying a Business is the Ultimate Wealth Creation Tool

Many aspiring business owners come from backgrounds in real estate, stock market trading, or corporate management. While these avenues offer varying degrees of income and wealth potential, owning a business outright creates unparalleled opportunities for financial freedom. Unlike flipping houses or managing rental properties, a well-run business can provide consistent cash flow and equity growth while offering you control over your career and future.

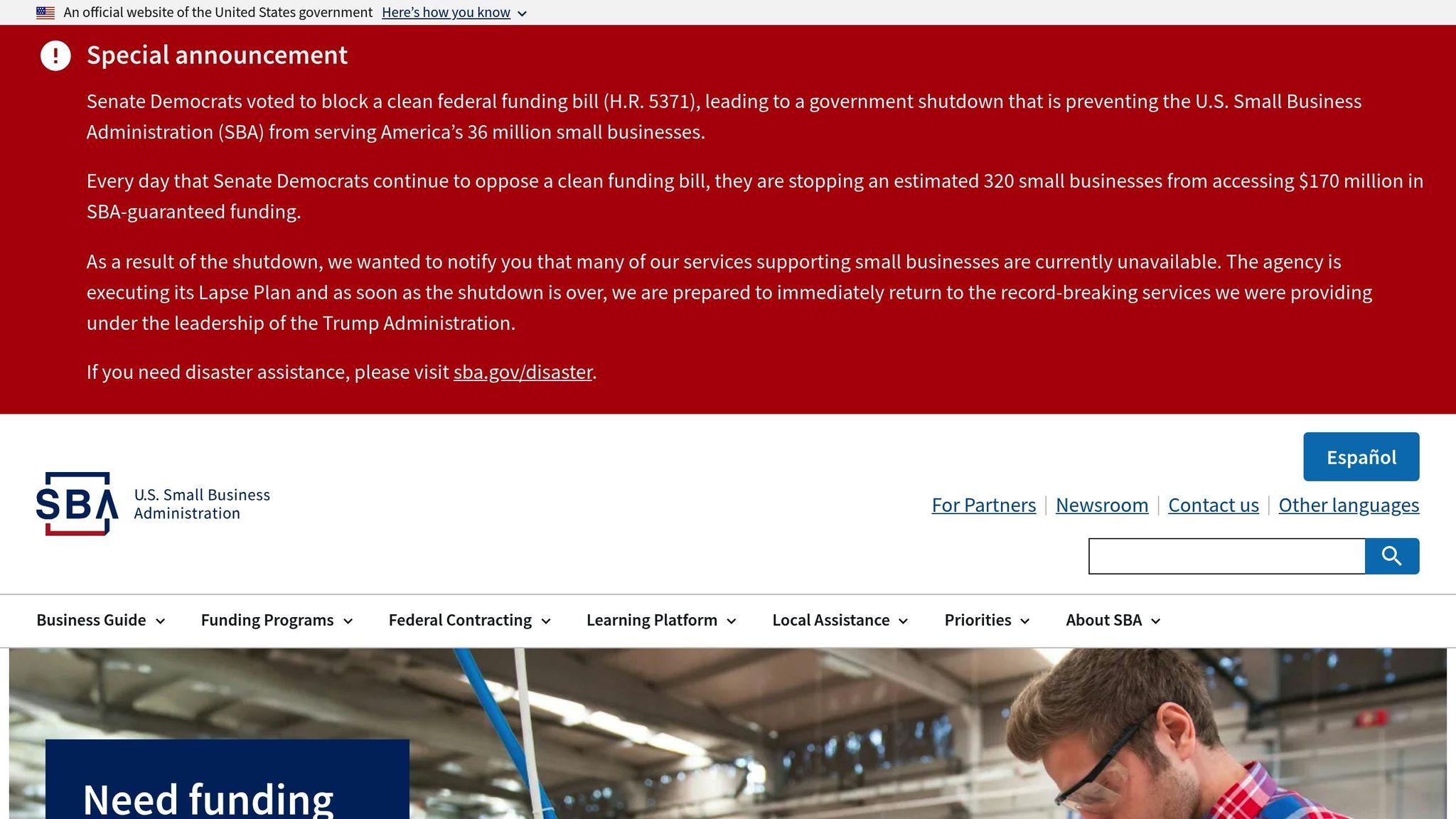

SBA loans have democratized business acquisitions, making it possible for first-time buyers to access funding that was once reserved for private equity groups. However, acquiring a business and successfully running it requires a nuanced understanding of financing, operations, and strategy. Let’s dive into the key elements of this process.

The Six Core Principles of Buying a Business with SBA Financing

1. The Importance of Experience

When banks evaluate a loan application, they assess whether you’re equipped to run the business you’re buying. Your professional background, management experience, and industry knowledge all play a role. But don’t worry if you lack direct experience in the target industry. Banks like Huntington Bank often consider transferable skills or "indirect experience." For example, leadership roles, operational management, or even mentorship from the seller are all factors that can give you a competitive edge.

In cases where industry-specific licensing is required (e.g., HVAC, medical practices), you must demonstrate how you’ll meet those requirements. One option is securing a management team member with the necessary licenses before closing the deal.

Key Insight: Sellers can stay on temporarily as consultants during the transition period, offering on-the-job training to bridge gaps in your knowledge.

2. Understanding Bank Financing: Equity Injection and Liquidity

Financing a business acquisition with an SBA loan requires you to have "skin in the game." Banks typically expect a 20% equity injection, but there’s flexibility in how you meet this requirement. For instance, part of the down payment can come from seller financing, where the seller agrees to carry a portion of the loan as a note.

In addition to the down payment, banks assess your post-closing liquidity. Ideally, you should retain at least 10% of the loan amount in liquid assets after closing, ensuring you can meet unforeseen expenses or operational challenges.

Credit and Character: Your personal credit score and financial history will also be scrutinized. Typically, you’ll need a minimum FICO score of 680, a clean background check, and no history of government debt defaults.

3. Creating a Game Plan for Post-Close Business Operations

Contrary to what some may believe, SBA-funded businesses are not passive investments. The SBA requires you to be actively involved in the day-to-day operations, even if the business has a strong management team in place. Whether it’s reviewing financial performance, making strategic decisions, or engaging with employees, your role as an owner-operator is critical.

For buyers transitioning from corporate jobs, this shift from employee to employer mindset is essential. Running a business involves navigating market fluctuations, managing a team, and adapting to unforeseen challenges. Developing a two-year business plan that outlines your operational strategy post-acquisition can go a long way in demonstrating your readiness.

4. Targeting the Right Business and Industry

Not all businesses are created equal. When evaluating a potential acquisition, consider the risk profile of the industry. High-risk industries, such as startups or certain regulated sectors (e.g., marijuana or firearms), may face greater scrutiny from lenders or even outright rejection under SBA guidelines.

Beyond industry risk, focus on the financial performance and trends of the business. A stable or growing cash flow is ideal; declining revenues or inconsistent profitability may deter lenders. Pay close attention to the following:

- Gross margins and operating expenses: Are they in line with industry benchmarks?

- Year-over-year trends: Are revenues, costs, and profits trending upward?

- Sustainability of cash flow: Can the business consistently cover debt service?

Pro Tip: Engage an M&A advisor or CPA to help assess the quality of earnings and uncover potential red flags during due diligence.

5. Building Your Deal Team

Buying a business is a collaborative process. To succeed, surround yourself with a deal team that includes:

- An SBA lender: A bank like Huntington Bank that specializes in SBA loans and offers expertise in structuring deals.

- An M&A attorney: Specialized legal support for reviewing purchase agreements, contracts, and compliance.

- A due diligence expert (CPA or financial analyst): To analyze the business’s financial health and ensure accurate valuations.

- An M&A advisor: A guide to help manage the entire transaction, from sourcing opportunities to finalizing the deal.

Your team will help you navigate the complexities of valuation, negotiation, and financing, ensuring that you don’t overpay or run into costly mistakes.

6. Navigating Deal Structure and Negotiation

The structure of the deal can make or break its viability. A business that doesn’t meet debt service coverage ratios (DSCR) may fail to secure financing, even if it shows strong top-line revenue. By working with an advisor and lender, you can negotiate terms that reduce risk, such as:

- Seller financing to lower your equity injection.

- Earnouts to tie part of the purchase price to future performance.

- Including working capital in the loan package to ensure smooth operations post-close.

Negotiation Tip: Many deals fall apart due to improper structuring or unrealistic pricing. Ensure you’re armed with an accurate valuation before making an offer.

Key Takeaways

- Experience Matters: Banks look for direct or transferable skills to ensure you can run the business post-acquisition. Consider consulting agreements with sellers to ease the transition.

- Prepare for Equity Injection: Expect to contribute at least 10% of the purchase price from your funds, with creative options like seller financing to meet the total 20% requirement.

- Active Ownership is Required: SBA loans are designed for actively managed businesses, not passive investments. Have a clear plan for your involvement.

- Do Your Homework: Analyze the business's financial trends and industry stability. Steer clear of high-risk sectors or businesses with declining revenues.

- Leverage a Deal Team: Success depends on collaboration with experts, including SBA lenders, M&A advisors, attorneys, and financial analysts.

- Negotiate Smartly: Structure deals to meet lender requirements while reducing your initial outlay. Seller notes and earnouts can enhance affordability.

Final Thoughts

Buying a business is one of the most rewarding yet complex transactions you can undertake. By leveraging SBA loans, you can access significant funding to acquire a cash-flowing business that aligns with your goals. However, success hinges on preparation, strategic planning, and assembling the right team to guide you through each phase of the process.

If you’re serious about acquiring a business, take the time to understand the nuances of SBA financing, master the art of negotiation, and ensure that you’re set up for long-term success. With the right mindset and expertise, owning a profitable business can be the ultimate wealth creation tool that transforms your life.

Source: "How to Buy a $500K/Year Business With an SBA Loan (Step-by-Step Guide)" - Leo Landaverde, YouTube, Sep 25, 2025 - https://www.youtube.com/watch?v=Y7q7CWJGNDM

Use: Embedded for reference. Brief quotes used for commentary/review.

%20%20Process%2C%20Valuation%20%26%20Legal%20Checklist.png)

%20in%20a%20%2420M%20Sale..png)

%20vs.%20Conventional%20Loans%20for%20business%20acquisition.png)

.png)

.png)

.png)

.png)