Invoice factoring is a fast, debt-free way for small and medium-sized businesses (SMBs) to solve cash flow issues caused by delayed customer payments. By selling unpaid invoices to a factoring company, businesses can get immediate cash - typically 70%-100% of the invoice value - minus a small fee.

In 2025, with rising interest rates and stricter lending criteria, choosing the right factoring partner is more critical than ever. The top companies prioritize transparent fees, quick funding, flexible contracts, and excellent customer service. Here's a quick look at the top 10 factoring companies for SMBs:

- FundThrough: Offers 100% advance rates with no long-term contracts and same-day funding.

- Riviera Finance: Provides up to 95% advance rates and non-recourse factoring, with 24-hour funding.

- altLINE: Known for transparent pricing and no hidden fees, with advance rates of 80%-90%.

- Triumph Business Capital: Specializes in flexible, contract-free factoring, with same-day funding.

- RTS Financial: Focuses on freight factoring with competitive rates and fast funding.

- eCapital: Uses AI for quick approvals, offering both recourse and non-recourse options.

- Kapitus: Supports large invoice volumes with rates starting at 1.25%.

- Universal Funding: Offers low fees (0.55%-2%) and high advance rates (up to 95%).

- Scale Funding: Flexible contracts with funding up to $10 million.

- 1st Commercial Credit: Competitive rates (0.69%-1.59%) with no minimum funding requirements.

Quick Comparison

| Company | Factoring Rate | Advance Rate | Funding Speed | Contract Terms |

|---|---|---|---|---|

| FundThrough | 2.2%-3% | 100% | Same day | No long-term contract |

| Riviera Finance | Starts at 2% | Up to 95% | Within 24 hours | 6 months |

| altLINE | 0.5%-3% | 80%-90% | 24-48 hours | 6-12 months |

| Triumph Business | 1%-4% | Up to 95% | Same day | No contract required |

| RTS Financial | 1.15%-4.5% | Up to 90% | Same day | Flexible terms |

| eCapital | 2%-5% | Up to 95% | Within 24 hours | Varies |

| Kapitus | 1.25%-5% | Up to 90% | 24-48 hours | 12-24 months |

| Universal Funding | 0.55%-2% | Up to 95% | Within 24 hours | 1-2 years |

| Scale Funding | 1.5%-3.5% | Up to 90% | 24-72 hours | Month-to-month/12 mo |

| 1st Commercial Credit | 0.69%-1.59% | Up to 97% | Within 24 hours | 6-12 months |

These companies offer solutions tailored to industries like trucking, staffing, and manufacturing. Whether you're looking for flexibility, speed, or competitive rates, there's a factoring partner to fit your needs.

Is Invoice Factoring Suitable For Small Businesses? - BusinessGuide360.com

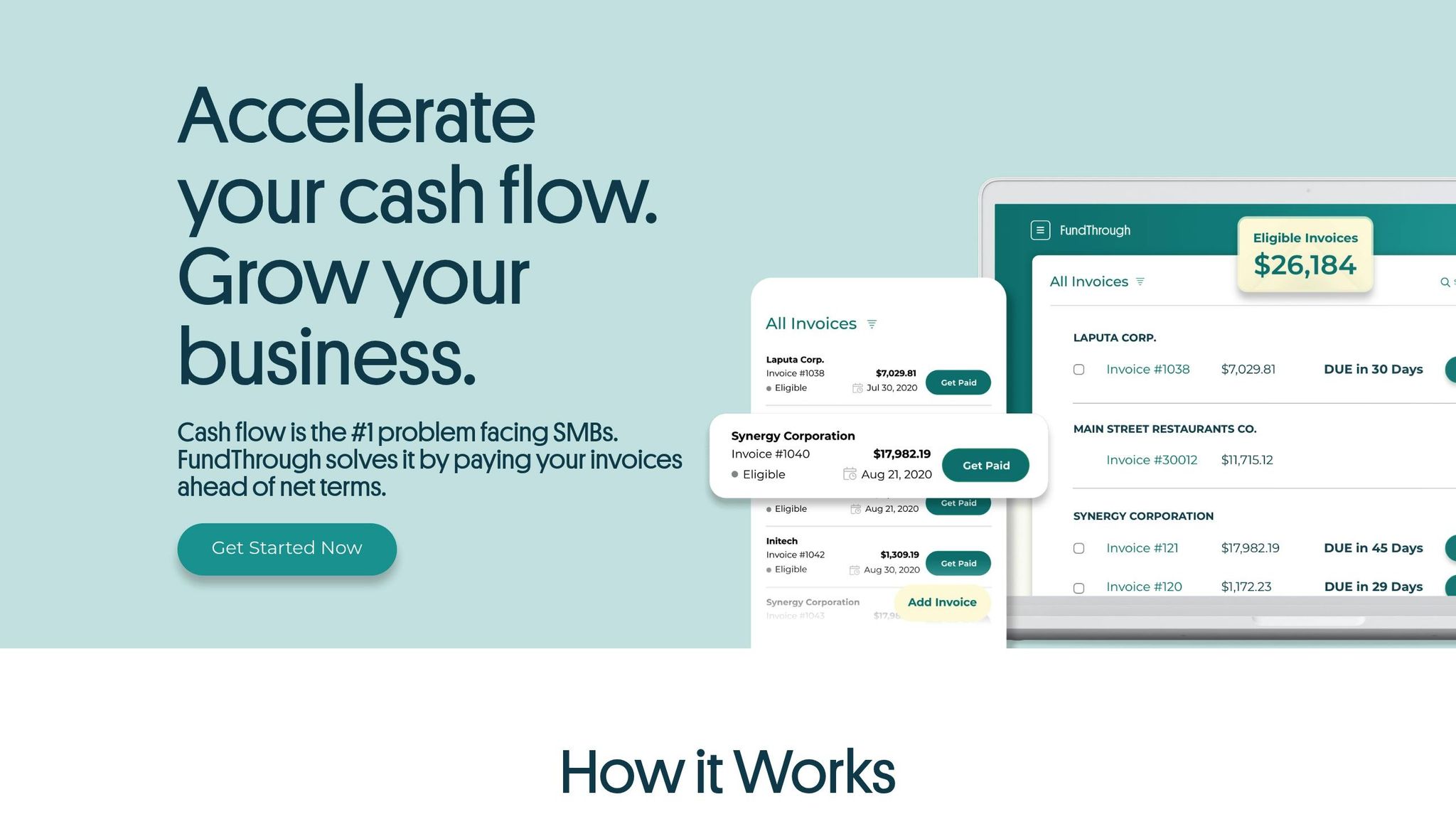

1. FundThrough

FundThrough has emerged as a top choice for small and medium-sized businesses (SMBs) in 2025, thanks to its competitive pricing and lightning-fast funding process. Recognized as Forbes Advisor's Best Overall Factoring Company for 2025, it’s a trusted partner for businesses seeking dependable cash flow solutions. With a 4.7-star rating on Google and over $1 billion funded to SMBs, FundThrough continues to set a high standard in the invoice factoring industry.

Fees and Advance Rates

FundThrough is known for offering some of the most competitive rates in the industry. Fees start as low as 2.2% per 30 days, ranging from 2.2% to 3% for invoices up to $999,999, with custom pricing available for larger amounts. What truly sets FundThrough apart is its 100% advance rate - significantly higher than the industry standard of 70%–90%. This means businesses can access the full value of their invoices upfront, minus a flat fee, avoiding the usual delays associated with traditional factoring services. These favorable terms provide both value and speed for businesses.

Funding Speed

When it comes to speed, FundThrough delivers same-day funding by utilizing advanced automation and seamless integrations with platforms like QuickBooks and OpenInvoice. According to the company, this makes their funding process 97% faster than many competitors. Setting up an account is straightforward - businesses simply provide basic information about their operations and customers to determine eligibility, ensuring a quick path to funding.

"The platform is intuitive and speeds up payments significantly!" - Sheena Russell, Made with Local

Contract Flexibility

FundThrough’s flexibility is another standout feature. There are no long-term contracts, allowing businesses to fund invoices on an as-needed basis. Companies can choose which invoices to factor and when to factor them. For added convenience, FundThrough offers spot factoring, enabling businesses to fund individual invoices as situations arise. Once an invoice is paid to FundThrough, there are no further commitments.

"Absolutely not! There's no long-term contract to use FundThrough's services. We have clients who fund all their invoices for a reliable cash flow solution, while others simply enjoy having FundThrough in their back pocket, ready for a rainy day cash flow gap." - FundThrough

This flexibility ensures that businesses can adapt their use of FundThrough’s services based on their immediate financial needs, without worrying about penalties or rigid terms.

2. Riviera Finance

Since its founding in 1969, Riviera Finance has built a solid reputation with over five decades of experience. With 25+ offices across the U.S. and Canada and a client base exceeding 2,000 businesses, the company has earned high praise, including a 5.0 Forbes Advisor rating and a 4.9-star rating on Google.

Fees and Advance Rates

Riviera Finance provides advance rates of up to 95% of the invoice value. Financing amounts range from $5,000 to $2 million, offering flexibility for businesses of various sizes. While specific fees depend on individual agreements, industry data suggests rates typically begin at 2%. This straightforward pricing approach ensures business owners can make informed financial decisions without unnecessary complications.

"Riviera's factoring fees are simple and straightforward, giving the business owner the most flexibility and power to make the best decision for his or her business." - Riviera Finance

The competitive pricing is matched by a fast funding process, making it an appealing option for businesses in need of quick access to cash.

Funding Speed

One of Riviera Finance's standout features is its promise of funding within 24 hours of approval. This fast turnaround is a key part of their service.

"Our process is built around immediate response to client needs, and the best cash turnaround in the industry." - Riviera Finance

For example, a transportation broker in Colorado faced seasonal cash flow challenges due to a surge in new contracts. Riviera Finance stepped in with a full-service factoring line, converting invoices to cash within 24 hours. This enabled the client to double their factored volume between April and June. The company’s quick funding process is designed to help businesses manage growth and changing financial demands effectively.

Recourse vs. Non‑Recourse Options

Riviera Finance specializes in non-recourse factoring, which shields businesses from losses if customers fail to pay. By taking on the credit risk, Riviera Finance allows companies to focus on their operations without worrying about customer defaults. The company supports both B2B and B2G clients and imposes no credit score requirements for businesses seeking their services.

Contract Flexibility

Riviera Finance offers flexible contract options, with no requirement for long-term commitments. Most contracts average six months but can be adjusted to suit the specific needs of a business, whether shorter or longer.

"Simple applications, no set-up fees, and adjustable contract terms make getting started with Riviera easy." - Riviera Finance

Businesses can also stop factoring at any time. However, for those with longer-term agreements, there may be a termination fee for early cancellation. This flexibility makes Riviera Finance an attractive choice for companies looking for adaptable financial solutions without being locked into rigid terms.

3. altLINE

altLINE stands out with its straightforward fee structure, avoiding the hidden costs that often come with traditional financing. The company offers a clear, reliable solution for businesses needing steady cash flow without unnecessary complexity.

Fees and Advance Rates

altLINE provides advance rates between 80% and 90% of an invoice's face value. Their factoring fees range from 0.5% to 3.0%, ensuring predictable and transparent costs. There is an initial filing fee of $350 to $500, which may increase up to 1% of the credit line amount depending on individual circumstances. Unlike many competitors, altLINE eliminates fees for ACH transfers, lockboxes, monthly access, same-day funding, and renewals. Wire transfers are charged a flat $30, and credit approvals are completely free.

Here’s how altLINE compares to other factoring companies:

| Fee Type | altLINE | Other Factoring Companies |

|---|---|---|

| ACH Fees | None | $5 – $30 per transaction |

| Lockbox Fee | None | $50 – $1,000 per month |

| Monthly Access Fee | None | Up to $300 |

| Same Day Funding Fee | None | 1% |

| Credit Approvals | $0 | $35 – $100 |

Funding Speed

altLINE delivers fast funding, offering same-day funding capabilities. Once a relationship is established, invoices are typically funded within 1–2 days, and subsequent invoice approvals are advanced within 24 hours. The company can manage high volumes, factoring up to $4 million per month while advancing up to 90% of invoice values.

For instance, Supreme Staffing, a company dealing with cash flow issues due to clients' net 30 payment terms, partnered with altLINE. Now, they receive an immediate 85% advance upon invoicing their clients, with the remaining balance - minus fees - released when the invoice is paid. This quick funding process provides businesses with reliable and consistent financing.

Contract Flexibility

altLINE typically requires contracts lasting 6 to 12 months, though shorter or longer terms might be offered depending on specific needs. While the company does not support one-off transactions, this contract structure is designed to build stable, ongoing relationships. It’s a great fit for businesses with regular invoicing cycles that need dependable access to working capital.

4. Triumph Business Capital

Triumph Business Capital provides invoice factoring with no contracts and straightforward pricing. Initially focused on trucking and freight, the company has expanded its services to industries like staffing, oil and gas, manufacturing, telecommunications, and general services.

Fees and Advance Rates

Triumph Business Capital stands out with its clear pricing and quick funding. Discount rates range between 1% and 4%, and businesses can receive advance rates of up to 100% with no reserves, giving them immediate access to the full value of their invoices. To qualify, businesses need a personal credit score of 500 or higher. Beyond factoring, Triumph offers additional perks like fuel card programs, insurance options, and equipment financing, making it a comprehensive solution for businesses seeking fast and efficient funding.

Funding Speed

With Triumph Business Capital, approved invoices can be funded on the same day. In fact, 85% of approved invoices are funded within 24 hours, with an average approval time of just 4.2 hours. Handling over $5 billion in annual transactions and maintaining 99.9% uptime reliability, Triumph ensures businesses have uninterrupted access to their funds.

"With same-day payments, fuel discounts, and back-office support, they've become a trusted partner in the trucking industry." - empwrtrucking.com

Their MyTriumph portal and mobile app let businesses track invoices and payments in real time. To speed up the process, businesses should ensure all required documents are submitted promptly.

Contract Flexibility

Triumph Business Capital offers contract-free factoring, giving businesses flexibility that traditional lenders often lack. There are no minimum invoice requirements or long-term commitments, allowing businesses to use the service as needed. This flexible setup has helped Triumph achieve an impressive 92% client retention rate.

Recourse vs. Non-Recourse Options

Triumph provides both recourse and non-recourse factoring options, giving businesses control over their risk exposure. The non-recourse option protects businesses from customer defaults.

"We'll protect your business even if your customer goes bankrupt. Triumph takes the risk on approved brokers - no charge backs!" - Triumph.io

5. RTS Financial

RTS Financial focuses on freight factoring, offering a blend of invoice factoring, fuel discounts, and trucking software. This makes it a strong choice for transportation and logistics businesses, where maintaining steady cash flow is crucial for small and medium-sized companies.

Fees and Advance Rates

RTS Financial provides advance rates of up to 97% of the invoice value. They stand out by not charging additional fees like volume fees, ACH fees, or invoice-upload fees. However, specific factoring rates aren’t listed on their website. Instead, pricing details are shared after reviewing an application. Generally, factoring fees in the industry range between 1% and 5% of the invoice total.

Funding Speed

Speed is a major focus for RTS Financial. They offer same-day funding through their RTS Pro mobile and web app, ensuring payments are processed within 24 hours after invoice approval.

Contract Flexibility

Some customer reviews have highlighted challenges with exiting contracts. It’s essential to carefully review the terms and any exit clauses to ensure they align with your long-term goals.

6. eCapital

eCapital is a factoring company that uses advanced technology to support small and medium-sized businesses across a variety of industries. It offers both recourse and non-recourse factoring, giving businesses the flexibility to choose how they manage risk. By utilizing AI, eCapital ensures quick access to working capital, helping businesses keep their operations running smoothly. Here’s a closer look at their fees, funding speed, contract terms, and factoring options.

Fees and Advance Rates

eCapital's pricing depends on factors like the industry, the risk profile of the business, and the volume of invoices. Typically, businesses with lower risk can secure better rates. For instance:

- Transportation companies: Factoring rates range from 1.95% to 4.0%, with advance rates between 97% and over 100%.

- Healthcare providers: Rates fall between 2.5% and 4.5%, with advance rates from 85% to 95%.

- Staffing agencies: Rates range from 1.95% to 4.5%, with advances between 85% and 97%.

General rates across industries tend to be between 2% and 5% of the invoice amount. Below is a quick reference table:

| Industry | Factoring Rate | Advance Rate |

|---|---|---|

| Transportation | 1.95% – 4.0% | 97% – 100%+ |

| Healthcare | 2.5% – 4.5% | 85% – 95% |

| Staffing | 1.95% – 4.5% | 85% – 97% |

| General Small Business | 1.95% – 4.5% | 85% – 95% |

Funding Speed

Thanks to its tech-driven approach, eCapital can onboard and fund businesses in just a few hours. Once invoices are verified, funds are typically transferred within 24 hours. This rapid turnaround helps businesses maintain a steady cash flow. As CEO Marius Silvasan puts it:

"AI is a game-changer when it comes to efficiency in reconciling invoices and payments. We've built a platform that can process requests within minutes and provide funding 24/7. This speed and reliability can be a lifeline for small businesses facing urgent liquidity issues."

With the platform's ability to process funding requests around the clock, businesses can access capital whenever they need it - no waiting for traditional banking hours.

Contract Terms

eCapital primarily provides contract factoring, also known as whole ledger factoring. This requires businesses to commit to factoring most or all of their invoices over a specific period. While this arrangement offers consistency, it’s less flexible compared to spot factoring, which allows businesses to factor invoices on an as-needed basis. Carefully reviewing contract terms is crucial to understanding obligations and any exit clauses.

Recourse vs. Non-Recourse Factoring

eCapital offers both recourse and non-recourse factoring options. With recourse factoring, fees are lower, but businesses remain responsible for unpaid invoices. Non-recourse factoring, on the other hand, protects businesses from non-payment risks. However, it comes with higher fees and more stringent credit requirements, making it a better fit for businesses with strong customer credit profiles.

sbb-itb-a3ef7c1

7. Kapitus

Kapitus helps small and medium-sized businesses (SMBs) turn their unpaid invoices into immediate cash. They specialize in factoring business-to-business (B2B) invoices and support trade credit terms like Net 30, Net 60, and Net 90. With factoring lines ranging from $200,000 to $7,000,000, Kapitus is well-suited for businesses handling large invoice volumes.

Fees and Advance Rates

Kapitus offers invoice factoring with competitive pricing. Their fee-based factoring product comes with an APR starting at 1.25%. Additionally, businesses should anticipate an origination fee starting at 2.5% of the total amount advanced. Factoring fees can be as low as 1.5%.

| Fee Type | Rate |

|---|---|

| APR (Fee-Based Product) | Starting at 1.25% |

| Origination Fee | Starting at 2.5% of advance |

| Lowest Available Rate | As low as 1.5% |

These rates aim to make the funding process both accessible and affordable.

Funding Speed

Kapitus stands out for its quick funding process. Once invoices are submitted, businesses can receive funding within 4 days. This allows SMBs to access cash much faster than waiting the typical 30 to 90 days for customer payments. This speed can be a game-changer for businesses needing to address cash flow gaps.

Contract Flexibility

Kapitus also offers flexibility in its financing options. While specific contract details are limited, one standout product is their revenue-based financing. This option ties payments to a percentage of the business's revenue, aligning with cash flow patterns. Payment periods typically range from 6 to 24 months and don’t require fixed monthly payments, making it a practical choice for businesses with seasonal or fluctuating revenue.

8. Universal Funding

Universal Funding builds on the strengths of other providers by offering small and medium-sized businesses competitive rates and fast access to cash. The company places a strong focus on transparent pricing and keeping fees to a minimum.

Fees and Advance Rates

Universal Funding sets itself apart with factoring rates ranging from 0.55% to 2% for the first 30 days. Their advance rates go as high as 95%, surpassing the industry average.

| Fee Type | Universal Funding | Industry Average |

|---|---|---|

| First 30 Days Rate | 0.55%-2% | 2.25%-3% |

| Advance Rate | Up to 95% | 80%-85% |

| Monthly Access Fee | $0 | Up to $100 |

| Credit Approvals | $35 per approval | Up to $100 |

| Same Day Funding Fee | None | 1% |

Universal Funding eliminates many fees that are common with other factoring providers. For example, there are no monthly access fees, overadvance charges, or same-day funding fees. Credit approvals cost just $35, while the lockbox fee is $50, and outgoing wire fees are $30. This straightforward pricing structure simplifies costs and makes funding more accessible.

Funding Speed

Speed is a key advantage with Universal Funding. After your account is approved, you can receive funding within two hours of submitting invoices. The initial approval process is also quick, often taking as little as two business days.

"Once approved, you can receive funding within two hours of submitting your invoices. This speed helps cover payroll, inventory, and new opportunities." - Universal Funding Corporation

For new clients, funding is typically available within 24–48 hours after account approval.

Contract Flexibility

Universal Funding's contracts are designed to be flexible, allowing businesses to factor invoices only when needed, without being locked into long-term obligations. This pay-as-you-go approach ensures businesses can access cash flow without restrictive agreements.

The company’s A+ rating from the Better Business Bureau highlights its dedication to customer satisfaction and ethical practices.

9. Scale Funding (formerly TCI Business Capital)

With three decades of experience, Scale Funding (formerly TCI Business Capital) has been a trusted partner for thousands of small and midsize businesses, offering dependable invoice factoring solutions. Let’s dive into their competitive fees, quick funding process, and adaptable contract options.

Fees and Advance Rates

Scale Funding provides funding amounts ranging from $50,000 to $10 million, with advance rates reaching up to 90%. They offer two contract options to accommodate different business needs:

- Month-to-Month Contracts: Rates vary based on the value of invoices, providing flexibility without long-term commitments.

- 12-Month Contracts: Discounted rates are available for businesses comfortable with a longer-term arrangement.

| Contract Type | Rate Structure | Advance Rate | Funding Range |

|---|---|---|---|

| Month-to-Month | Variable based on invoice value | Up to 90% | $50,000-$10M |

| 12-Month Contract | Discounted rates available | Up to 90% | $50,000-$10M |

These options allow businesses to choose the best fit for their cash flow needs and financial goals.

Funding Speed

One of Scale Funding’s standout features is its speed. They provide pricing quotes in as little as 15 minutes, giving businesses the clarity they need to make quick decisions.

"Scale Funding is a team of invoice factoring experts with over 30 years of experience providing working capital and expert support to thousands of small to midsize companies in various industries through our invoice factoring services. Scale Funding offers comprehensive credit services, streamlined invoice processing, and efficient account receivable management, accompanied by our responsive support team. Securing funding is a simple process and can be done in as little as 24 hours."

Once approved, businesses can access funding within 24 hours, ensuring they maintain steady cash flow without unnecessary delays.

Contract Flexibility

Scale Funding stands out for its adaptable contract options. Businesses can opt for a month-to-month contract for maximum flexibility, ideal for those wanting to avoid long-term commitments. Alternatively, the 12-month contract offers discounted rates, making it a cost-effective choice for companies ready for a longer-term arrangement.

Whether you prioritize flexibility or savings, Scale Funding’s contract options are designed to align with your business needs while keeping cash flow running smoothly.

10. 1st Commercial Credit

1st Commercial Credit has been supporting businesses for over 20 years, funding more than 3,800 clients. Their approach to financing is designed to be flexible and free from the usual restrictions that small and medium-sized businesses (SMBs) often face.

Fees and Advance Rates

When it comes to costs, 1st Commercial Credit offers receivable financing rates between 0.69% and 1.59%. What really sets them apart is their advance rate of up to 97%, allowing businesses to access nearly the full value of their invoices upfront.

Unlike many competitors, they’ve removed several common hurdles for SMBs. There’s no minimum funding volume, no need for financial statements, and no long-term contracts. This makes their services accessible to businesses at every stage, whether you're just starting out or already established.

| Feature | Details |

|---|---|

| Receivable Financing Rates | 0.69% - 1.59% |

| Advance Rate | Up to 97% |

| Minimum Volume | None required |

| Financial Statements | Not required |

This transparent and flexible structure demonstrates their dedication to making financing simple and effective for businesses.

Funding Speed

If speed is a priority, 1st Commercial Credit delivers. Setting up an account typically takes just 3–5 days, which is faster than most traditional lenders. Once approved, invoices are funded within 24 hours. Decisions are often made within a single day, and for existing clients, additional working capital can be approved in just a few hours.

Contract Flexibility

One of the standout features of 1st Commercial Credit is their flexibility. They don’t lock clients into long-term contracts, giving businesses the freedom to adjust their financing as their needs evolve.

Their agreements usually span 6–12 months, providing a regular opportunity to review and adapt the arrangement. This short-term commitment ensures that businesses aren’t stuck in multi-year contracts that might not align with changing circumstances.

In addition to invoice factoring, they also offer purchase order financing and supply chain financing. This makes them a one-stop solution for businesses looking to streamline their financial processes and access working capital efficiently.

Company Comparison Table

When choosing an invoice factoring partner, it’s helpful to compare key features side by side. Below is a table summarizing important details like factoring rates, advance rates, funding speed, contract terms, and additional fees. Following the table, you'll find key insights to help you make an informed decision.

| Company | Factoring Rate | Advance Rate | Funding Speed | Contract Terms | Additional Fees |

|---|---|---|---|---|---|

| FundThrough | 2.75% per 30 days | 100% | Within 24 hours | No long-term contract | None |

| Riviera Finance | Starts at 2% per 30 days | 95% | Within 24 hours | 6 months | Early termination fee: 3% of max limit |

| altLINE | 0.5%-3% per 30 days | 80%-90% | 24-48 hours | 6-12 months | Origination fee: $350-$500 |

| Triumph Business Capital | 1%-4% per 30 days | Up to 95% | 24-48 hours | Varies | Not disclosed online |

| RTS Financial | 1.15%-4.5% per 30 days | Up to 90% | Same day | Flexible terms | Processing fees may apply |

| eCapital | Not disclosed | Up to 95% | Same day | Varies | None disclosed |

| Kapitus | 2%-5% per 30 days | Up to 90% | 24-48 hours | 12-24 months | Setup and maintenance fees |

| Universal Funding | 0.55%-2% per 30 days | Up to 95% | Within 24 hours | 1-2 years | Startup fee |

| Scale Funding | 1.5%-3.5% per 30 days | Up to 95% | 24-72 hours | 6-12 months | Monthly minimum fees |

| 1st Commercial Credit | 0.69%-1.59% | Up to 97% | Within 24 hours | 6-12 months | None required |

Key Insights

Factoring structures can vary between providers. Some offer flat rates, while others use tiered pricing models depending on factors like invoice size or client risk. Advance rates - the percentage of your invoice value paid upfront - also differ, with 1st Commercial Credit leading at up to 97%, while others range from 80% to 95%.

Speed of funding is another critical factor. Most companies provide same-day or next-day funding once your application is approved. However, contract terms can range from FundThrough's no long-term commitment to agreements lasting up to two years.

It’s important to note that the lowest advertised rate doesn’t always mean the best deal. Additional fees, such as origination or termination charges, and less flexible terms can offset lower rates. For example, altLINE has a competitive rate but includes a notable origination fee, while Kapitus applies setup and maintenance fees.

Finally, industry-specific risks and client profiles can influence rates and terms. Evaluating these factors will help you find a provider that aligns with your cash flow needs in 2025.

Conclusion

Invoice factoring offers a practical way for small and medium-sized businesses (SMBs) to tackle cash flow challenges. Given that cash flow problems are often cited as a leading cause of business failures, factoring serves as a lifeline by turning unpaid invoices into immediate working capital.

This approach allows businesses to maintain their credit and equity, as it doesn’t rely on traditional credit checks. Instead, factoring is based on the creditworthiness of your customers, making it an appealing option for startups, companies in transition, or those facing short-term financial hurdles. Some providers, like 1st Commercial Credit, even offer competitive rates starting at 0.69%. By ensuring a steady cash flow, factoring supports both day-to-day operations and long-term growth.

Advances in digital platforms and AI have made factoring faster and more transparent. These technologies enhance risk management and streamline funding processes. Additionally, the rise of non-recourse factoring - where the factoring company assumes the risk of unpaid invoices - adds another layer of financial flexibility. These innovations make it easier to find a factoring partner that aligns with your financial goals.

When choosing a provider, it’s important to look beyond just the advertised rates. Factors like advance percentages, funding speed, contract terms, and hidden fees can significantly impact your experience. Whether you prioritize flexible agreements, competitive pricing, or a full suite of services, there’s a factoring partner to meet your needs.

The global factoring market reached $3.95 trillion in 2023, with the U.S. market alone projected to hit $288 billion by 2030. This growth highlights the critical role factoring plays in helping businesses stabilize cash flow and scale effectively. Selecting the right partner not only addresses immediate financial concerns but also sets the stage for sustainable growth over time.

FAQs

What should I look for when selecting an invoice factoring company for my small or medium-sized business in 2025?

When selecting an invoice factoring company for your small or medium-sized business (SMB) in 2025, there are a few essential considerations to keep in mind. Start by looking into the company’s reputation and experience. A strong track record can provide peace of mind, showing they’re dependable and capable of delivering on their promises.

Another critical factor is funding speed. Access to cash quickly can make a big difference when managing your business’s cash flow and keeping operations running smoothly.

Take a close look at their terms and flexibility as well. Check for details like minimum invoice requirements and ensure their services align with your specific financial needs. Lastly, evaluate how they manage risk and whether they offer solutions that can support your business as it grows. Focusing on these aspects will help you choose a factoring partner that suits your business and supports its success.

What’s the difference between recourse and non-recourse factoring, and how do I choose the right option for my business?

The main distinction between these two factoring types lies in who bears the risk if a customer fails to pay their invoice. With non-recourse factoring, the factoring company assumes the risk of non-payment. This means your business is protected if a customer defaults due to insolvency or similar issues. While this option tends to cost more, it offers added security and can simplify your administrative workload.

In contrast, recourse factoring requires your business to repurchase unpaid invoices. Essentially, you’re on the hook for covering any non-payments. Although this option is usually less expensive, it comes with greater risk and necessitates thorough customer screening.

Choosing between the two depends on your business's risk tolerance and financial priorities. If avoiding financial risk is critical, non-recourse factoring might be the safer bet. However, if your customers are dependable and you're looking to cut costs, recourse factoring could be the more economical choice.

How does AI improve the speed and efficiency of invoice factoring services?

AI has transformed the world of invoice factoring, making the process faster and more efficient than ever before. By automating tasks like invoice processing, what once took days can now be done in just a few hours. This not only speeds things up but also cuts down on operational costs.

Technologies like optical character recognition (OCR) and machine learning play a big role here. They help reduce manual errors, simplify credit evaluations, and improve risk management, ensuring smoother operations.

For businesses, this means quicker payments, healthier cash flow, and less time spent on administrative tasks. With AI in the mix, invoice factoring services are now more dependable, budget-friendly, and better equipped to meet the needs of small and medium-sized businesses.

%20%20Process%2C%20Valuation%20%26%20Legal%20Checklist.png)

%20in%20a%20%2420M%20Sale..png)

%20vs.%20Conventional%20Loans%20for%20business%20acquisition.png)

.png)

.png)

.png)

.png)